Kalshi entered the trading zeitgeist during the 2024 presidential election and added sports markets in early 2025. It's available in all 50 states, and offers many markets that sportsbooks can't, including politics, weather and awards.

But Kalshi looks a little different than sports betting, mainly when it comes to pricing. So how does it work exactly? Let's dive in.

1. The Simple Explanation of Kalshi

If you don't care about how the markets get priced on the back end, there are really only two things you need to know — your total payout on each prediction, and your ability to trade in and out of positions.

The Total Payout

There are no American odds displayed on Kalshi's platform, like you'd expect at a sportsbook. Every market is listed in percentages (which you can convert to American odds with our odds converter, if you want).

I'll dive deeper into how the prices get made in Part 2, but don't be scared by financial mechanisms like the "orderbook" and "spread" and "contracts" if you're new to the platform. Kalshi does a good job displaying how much you'll win on a given trade, even if you don't know how everything "works" right away.

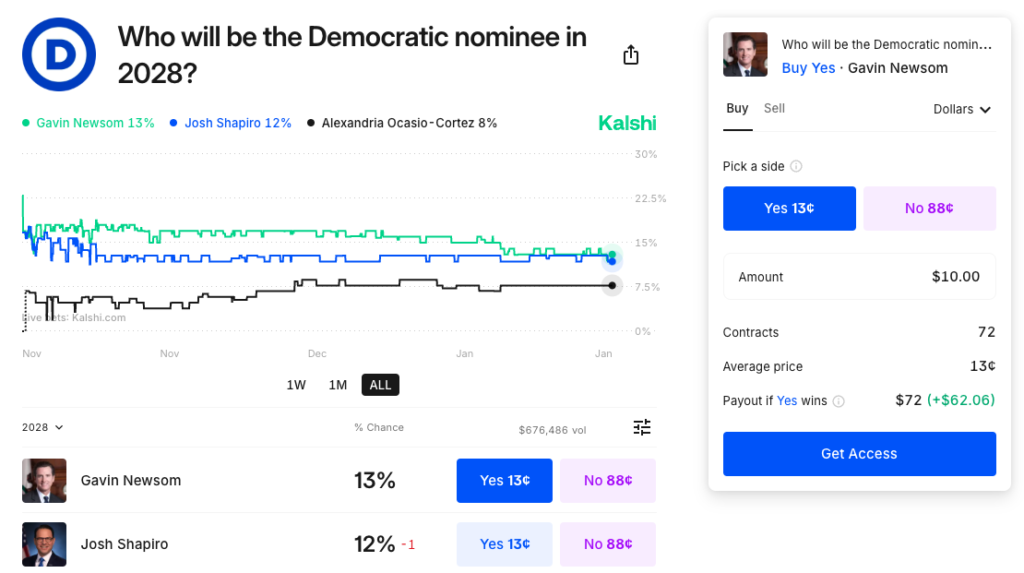

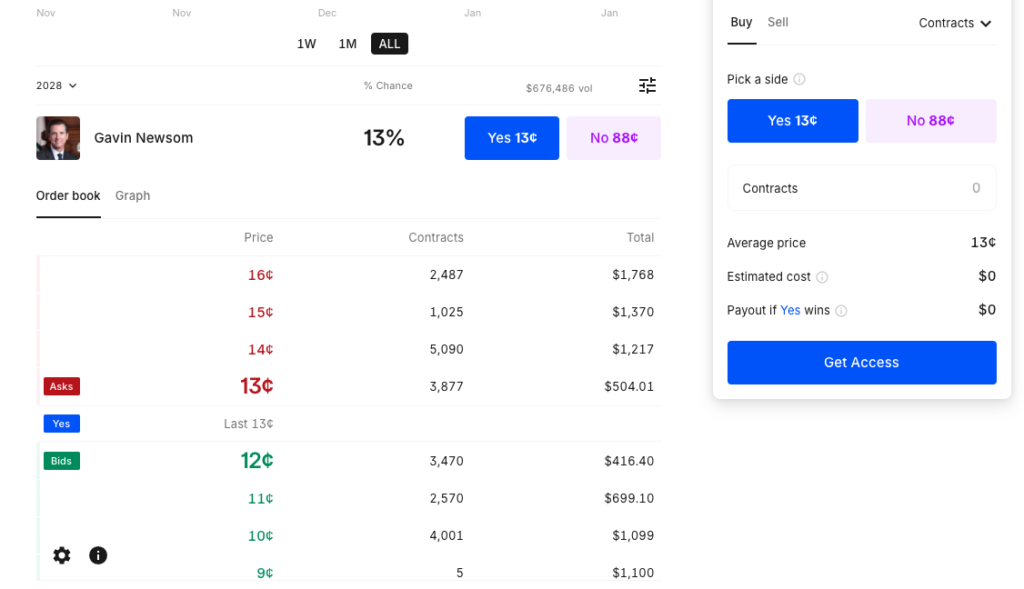

Here's an example. Say I want to place $10 on Gavin Newsom to be the Democratic nominee for president in 2028 at 13 cents. In my "trade slip" I put in $10, and it spits out my total payout — $62.06 in profit, and my $10 back, for $72 total. That means I'm getting this at about +620 in American odds.

I can also predict the "no" side at 88 cents, since it's a long shot right now that he wins the nomination. My $10 trade would pay $11.44 total, for $1.44 in profit.

Trading In & Out of Positions

Like the stock market, Kalshi wants to always give user the opportunities to trade in and out of positions. You don't have to ride every trade until the end — you can buy something, watch its value increase, then sell it for a profit. Or vice versa.

Navigate to the portfolio tab to see how your positions have changed in value since you entered the market.

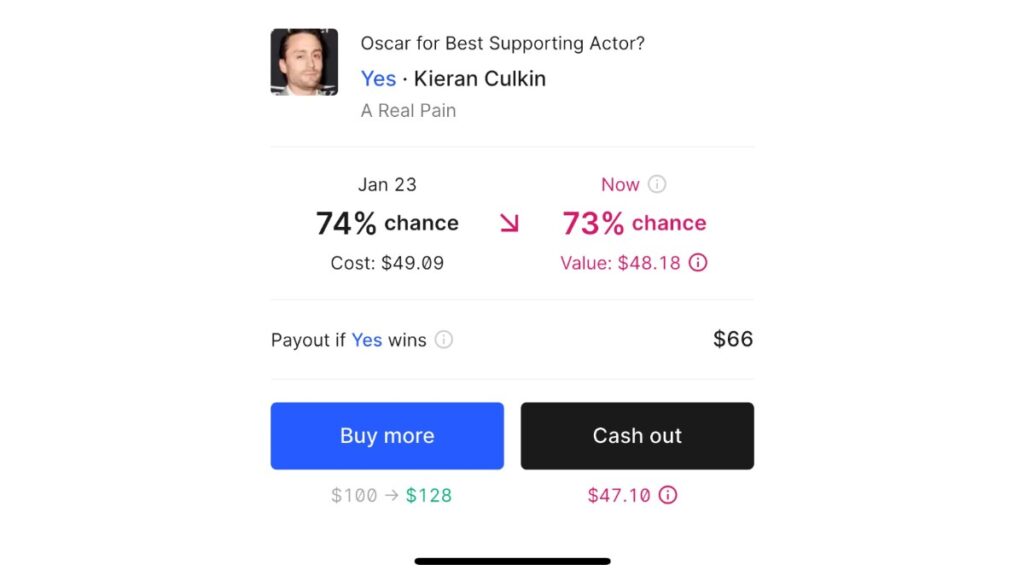

As we'll discuss in more detail below, you can easily trade in and out of positions based on what the current market price is (like you would with a stock). In this example, I put $50 on Kieran Culkin to win best supporting actor at the Oscars, but the current market prices are worse (73% chance) than what I bought it for (74%), so I would have to sell at a slight loss.

2. The In-Depth Explanation of Kalshi

How Contracts Work

Let's dive deeper into how we arrived at that +620 price for Newsom. The "yes, he will win the nomination" contract is priced at about 13.8 cents. The "no, he will not win the nomination" is priced at 88 cents.

What does that mean?

When you make a transaction, you're buying contracts. Each contract costs anywhere from 1-99 cents (the "yes" here costs 13.8 cents), and winning contracts settle at $1 and losing contracts settle at $0.

So a single 13.8 cent contract will settle at $1 if it wins, meaning you get 86.2 cents in profit plus your original 13.8 cents back.

- 13.8 cents -> $1 payout = 86.2 cents in total profit

- 86.2 profit / 13.8 wager = 6.24, or +624 in American odds. Add in fees and you're at about +620.

You're generally not going to be buying just a single contract and winning $1, but if you buy 100 contracts, the same payout math still applies.

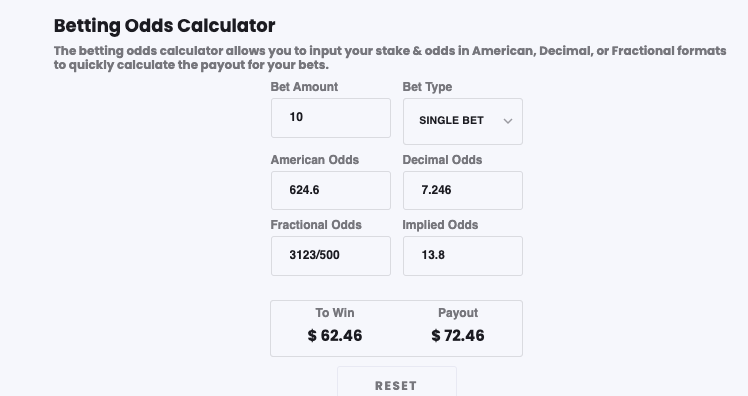

You can convert percentages to American odds using our odds calculator (which is preferred since the conversion math is different for wagers over 50% probability and under 50% probability).

As you can see in this example, that 13.8 cent contract we're buying on Newsom comes out to about +624, and with Kalshi's fees, the true payout is more like +620.

How Do the Odds Get Made?

Because all of Kalshi's markets are two-sided, there is no "oddsmaker" or "house," at least in the traditional sense. Instead, you're trading against other users, and the prices get made based on what people are buying and selling. All users can either buy an outcome, or sell it.

In this case, if I'm buying Newsom to win, I'm taking the "Yes" side. If I'm selling, I'm taking him to not win, and trading with someone on the other side who is buying the "yes" and thinks he will win.

Like in the stock market, there's an "orderbook" of what people are offering to buy and sell these outcomes at. In the example below, there is $504 total available to buy on Newsom at 13 cents. If I put $504 on that price, all that liquidity is gone and if someone wants to buy the same prediction after me, they'll be getting a slightly worse price at 14 cents. And with continued buying and selling, the market takes shape and arrives at the "correct" price.

Information will also change the markets, and traders will react accordingly. If Newsom announces he's stepping down as governor of California and leaving politics, anyone offering him at 13 cents will cancel that order quickly, and you won't be able to buy it.

Now, you're not always trading against some other "retail" user making a $20 trade. Kalshi uses market makers, like powerhouse trading firm Susquehanna International Group, which became their first institutional market maker in April 2024, to pump money into these markets so users can buy and sell easily. They make money by buying a contract, and then soon after selling that contract to someone else at a slightly higher price. Market makers make money by collecting the spread (the difference between the buy and sell prices).

Kalshi is also doing some of its own market making through a separate entity called Kalshi Trading, which does muddy their "peer to peer" argument a bit. On their site, they say it's "a different company with completely separate operations, and subject to strict informational barriers that prevent any non-public exchange information from being shared; they are a participant on the exchange just like everyone else."

Why Don't the Percentages Add Up to 100%?

The difference between the "yes" and "no" sides of a given trade is called the spread.

It's the gap between what the highest price a buyer will pay (bid) and the lowest price a seller will accept (ask). A narrow spread indicates high demand, while a wide spread indicates low demand. Market-makers make money by buying at a lower price and then selling at a higher price.

The bigger the gap between the "yes" and "no" means the market is less confident in the price. In a super-liquid market with lots of action, the two sides should be pretty close to 100% total.

Are There Fees/Vig?

At a sportsbook, you're paying a vig on each bet, which is priced into each market.

At Kalshi, they take fees instead. The fees vary depending on the odds/price of the market you're predicting.

If you're trading on long shots and heavy favorites, you'll pay less. If you're predicting outcomes that are closer to 50/50, you'll pay more. The most you'll ever pay on a $100 trade is $1.74 in fees.

You can get the whole fee schedule here.