BETZ Sports Betting ETF

Roundhill Investments' BETZ ETF has more than doubled in price in less than a year of existence as the American sports betting market has exploded. With new states coming online and new sportsbooks joining an already competitive landscape with money to spend, this market doesn't show signs of slowing down.

Roundhill launched this EFT in June 2020 to give investors broad exposure to the sports betting and iGaming industry without having to pick winners in this ultra-competitive and still young environment.

So what is BETZ, what stocks does it consist of, and how can you buy it? Let's dive in.

1. Well, What Is an ETF?

ETF stands for exchange-traded fund. It's a collection of stocks and other securities that can be bought as one stock to mirror the performance of an underlying index or industry.

SPY, which simply tracks the S&P500 performance, is an ETF. So is BETZ, which tracks the global sports betting and online gaming industry.

ETFs have an associated price like a stock and can easily be bought and sold at online brokerages.

2. How Do I Buy BETZ?

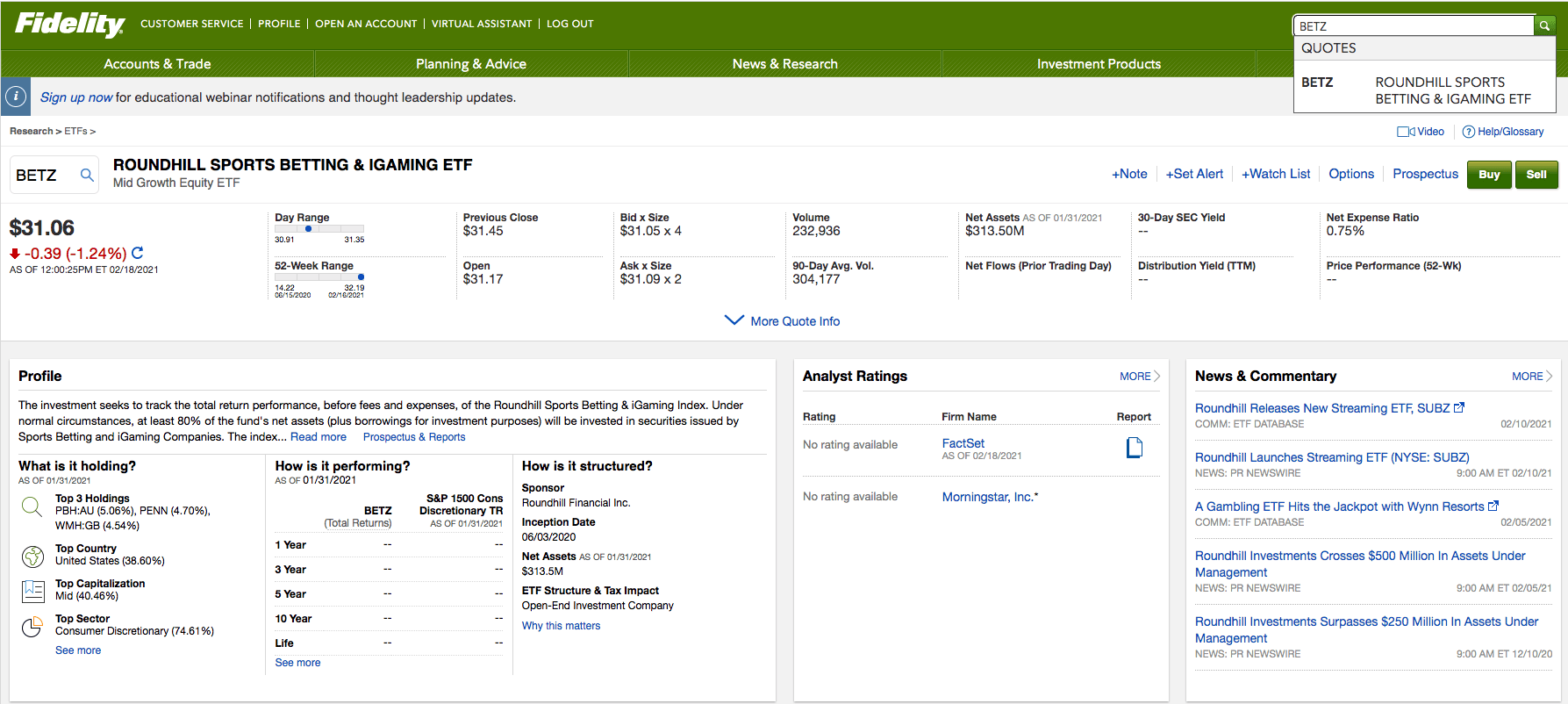

BETZ is traded on the New York Stock Exchange, so you can buy it easily on platforms like Fidelity, Charles Schwab, Webull, TD Ameritrade and more.

At Fidelity, simply type BETZ into the search bar to find the current quote and trade.

3. What Makes Up the BETZ ETF?

Roundhill grouped together 40 sports betting and online gaming stocks intended to mirror the performance of the industry.

BETZ is mostly made up of companies that operate sportsbooks, but also plenty of others tied to the industry. Kambi Group is a B2B operator providing odds and online interfaces to many American sportsbooks; Playtech does the same for online casinos. Better Collective and Catena Media drive customers to sportsbooks through affiliate marketing.

It features about 20% small-cap stocks (less than $1 billion market cap), 40% mid-cap ($1-$5B) and 40% large cap (greater than $5B).

By buying BETZ instead of individual stocks, you're betting that the entire industry will continue to take off. If PointsBet's growth slows but Penn National continues to take off behind the Barstool Sportsbook, you're covered.

It also comes with a different kind of floor and upside since it's diversified. BETZ has doubled in price since Roundhill launched in June 2020, from just over $15 to north of $31. Penn National and PointsBet are up 3X in the same time frame, while DraftKings is up only 45%, from about $40 to $58.

4. Stocks in BETZ

| Ticker | Name | % of ETF |

|---|---|---|

| PBH AU | POINTSBET HOLDINGS | 5.00% |

| KINDSDB SS | KINDRED GROUP PLC | 4.98% |

| PENN | PENN NATL GAMING INC | 4.72% |

| DKNG | DRAFTKINGS INC | 4.37% |

| WMH LN | WILLIAM HILL | 4.07% |

| Cash&Other | 4.05% | |

| ENT LN | ENTAIN PLC | 3.90% |

| KAMBI SS | KAMBI GRP PLC | 3.88% |

| FLTR LN | FLUTTER ENTERTAINM | 3.75% |

| EVO SS | EVOLUTION GAMING | 3.44% |

| GAN | GAN LTD | 3.41% |

| RSI | RUSH STREET INTERACTIVE INC | 3.13% |

| TAH AU | TABCORP HOLDINGS L | 2.96% |

| SGMS | SCIENTIFIC GAMES CORP | 2.84% |

| 888 LN | 888 HOLDINGS | 2.75% |

| PTEC LN | PLAYTECH PLC | 2.75% |

| CHDN | CHURCHILL DOWNS INC | 2.74% |

| SKLZ | SKILLZ INC | 2.73% |

| CZR | CAESARS ENTERTAINMENT INC NEW COM | 2.61% |

| BETS B SS | BETSSON AB | 2.26% |

| GNOG | GOLDEN NUGGET ONLINE GAMIN | 2.20% |

| BET AU | BETMAKERS TECHNOLO | 2.19% |

| MGM | MGM RESORTS INTERNATIONAL | 2.08% |

| BALY | BALLYS CORPORATION | 2.03% |

| LEO SS | LEOVEGAS AB | 1.98% |

| DMYD | DMY TECHNOLOGY GROUP INC II | 1.94% |

| BYD | BOYD GAMING CORP | 1.93% |

| GYS LN | GAMESYS GROUP PLC | 1.86% |

| CTM SS | CATENA MEDIA P.L.C | 1.84% |

| NLAB SS | ENLABS AB | 1.08% |

| GMR LN | GAMING REALMS PLC | 0.46% |

| ACX GR | BET-AT-HOME.COM | 0.43% |

| ASPIRE SS | ASPIRE GLOBAL PLC | 0.43% |

| BNRMW58 | SCORE MEDIA AND GA COM NPV CL A SB VTG SH(R/S) | 0.41% |

| GIG NO | GAMING INNOVATION | 0.30% |

| SCOUT SS | SCOUT GAMING GROUP | 0.27% |

Note: This is an educational post and should not be used as financial advice.