On Wednesday, DraftKings announced that it had acquired the leading microbetting provider Simplebet.

While the purchase price wasn’t disclosed in a DraftKings press release, JMP Securities reported that DraftKings, which already owned 15% of Simplebet, paid $195 million for the remaining 85% of the company, with a $70 million upfront payment.

“Live betting represents an area for potential growth for online sports betting, and the proposed acquisition would allow DraftKings to leverage Simplebet’s proprietary technology to create an in-play wagering experience that moves at the speed of sports,” Corey Gottlieb, DraftKings’ Chief Product Officer, said in the release. “And while we continue to elevate our product offering in this space, we are also committed to building technology that supports our robust consumer protection standards.”

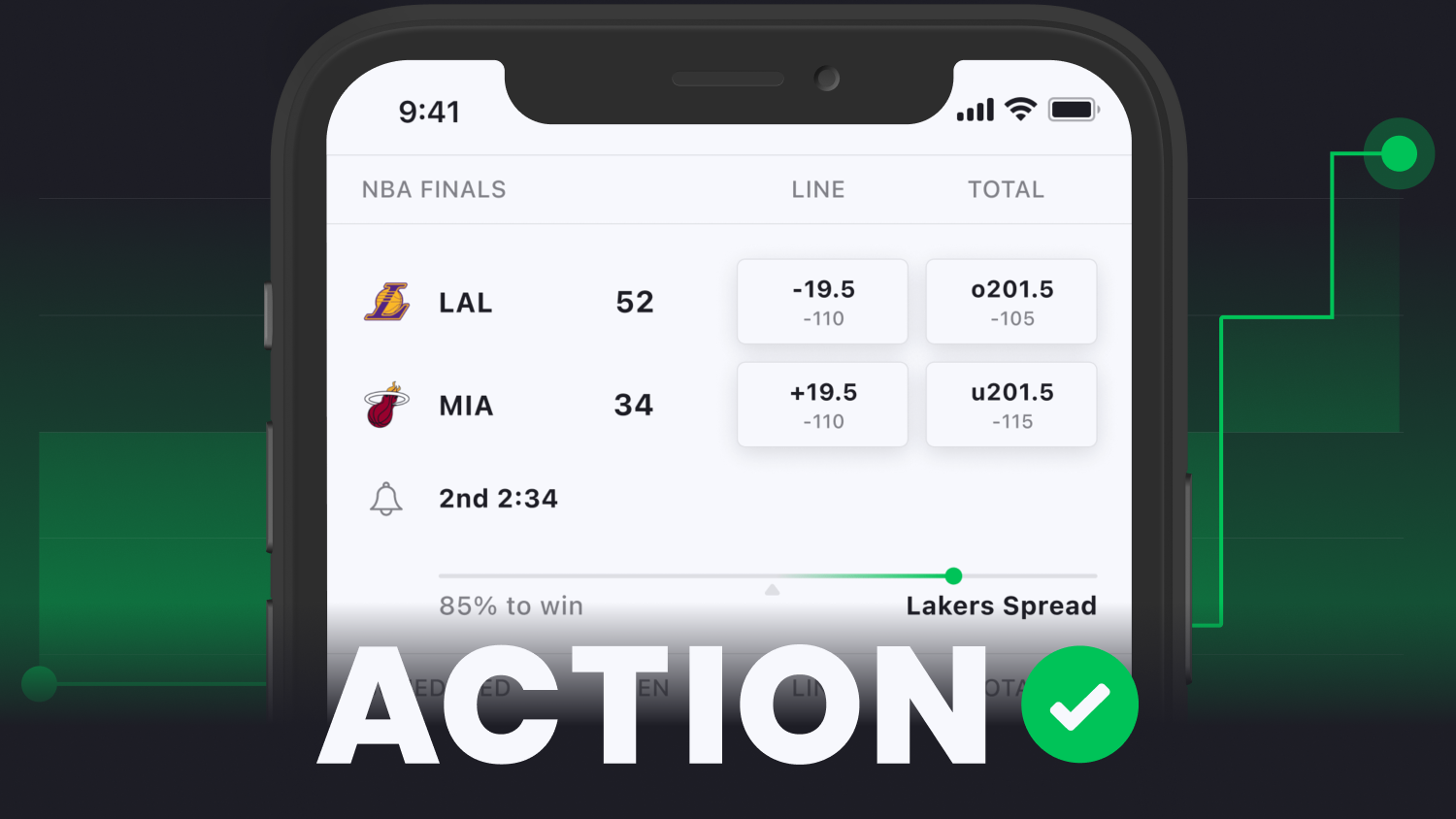

In-game betting has grown consistently more popular in the U.S. since Simplebet launched its product during the COVID pandemic in 2020. And that product is as granular as it gets when it comes to its capacity to offer just about any in-game wager under the sun.

As Matt Rybaltowski wrote when rumors of the DraftKings-Simplebet deal first began swirling in May, “Through certain sportsbook partners, Simplebet offers totals on the speed of the next pitch. For baseball, Simplebet’s models contain data from at least 4.8 million MLB pitches over the past 15 years. The New York-based provider also incorporates machine learning tools from at least 800,000 historical at-bats to power its proprietary in-game betting engine. A ball on a 1-1 count to [Shohei] Ohtani could drastically alter the odds of the Dodgers scoring a run in the first inning.”

Given that it’s the dominant B2B provider of in-game sports betting technology to U.S. sportsbooks, an obvious question is what will happen to Simplebet’s existing relationships with DraftKings’ rivals, among them Caesars and bet365. In a note on the transaction, JMP analyst Jordan Bender wrote, “We believe industry operators could look to other microbetting technology companies, including nVenue, Kero Sports and Huddle, to power the product offering.”

The Simplebet acquisition comes amidst a flurry of M&A activity involving DraftKings, including the purchases of digital lottery app Jackpocket and odds provider Sports IQ Analytics, as well as the sale of Vegas Stats & Information Network.