The Supreme Court upended U.S. sports betting three years ago, striking down the federal wagering ban and permitting all states and territories the right to legalize wagering within their borders. Since then, more than half the states (plus Washington D.C. and Puerto Rico) have accepted a legal wager or passed legislation to do so, accepting more than $50 billion in wagers during that time.

Those existing market handle and revenue figures are projected to grow in the coming years. But much of the national sports betting market’s fate depends on legalization efforts in its four most-populated states in the three years to come.

California, Texas, Florida and New York have all considered sports betting legislation since the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) on May 14, 2018. Several of those states have already cleared major political or logistical hurdles to do so, but significant work — and uncertainty — remain for all four.

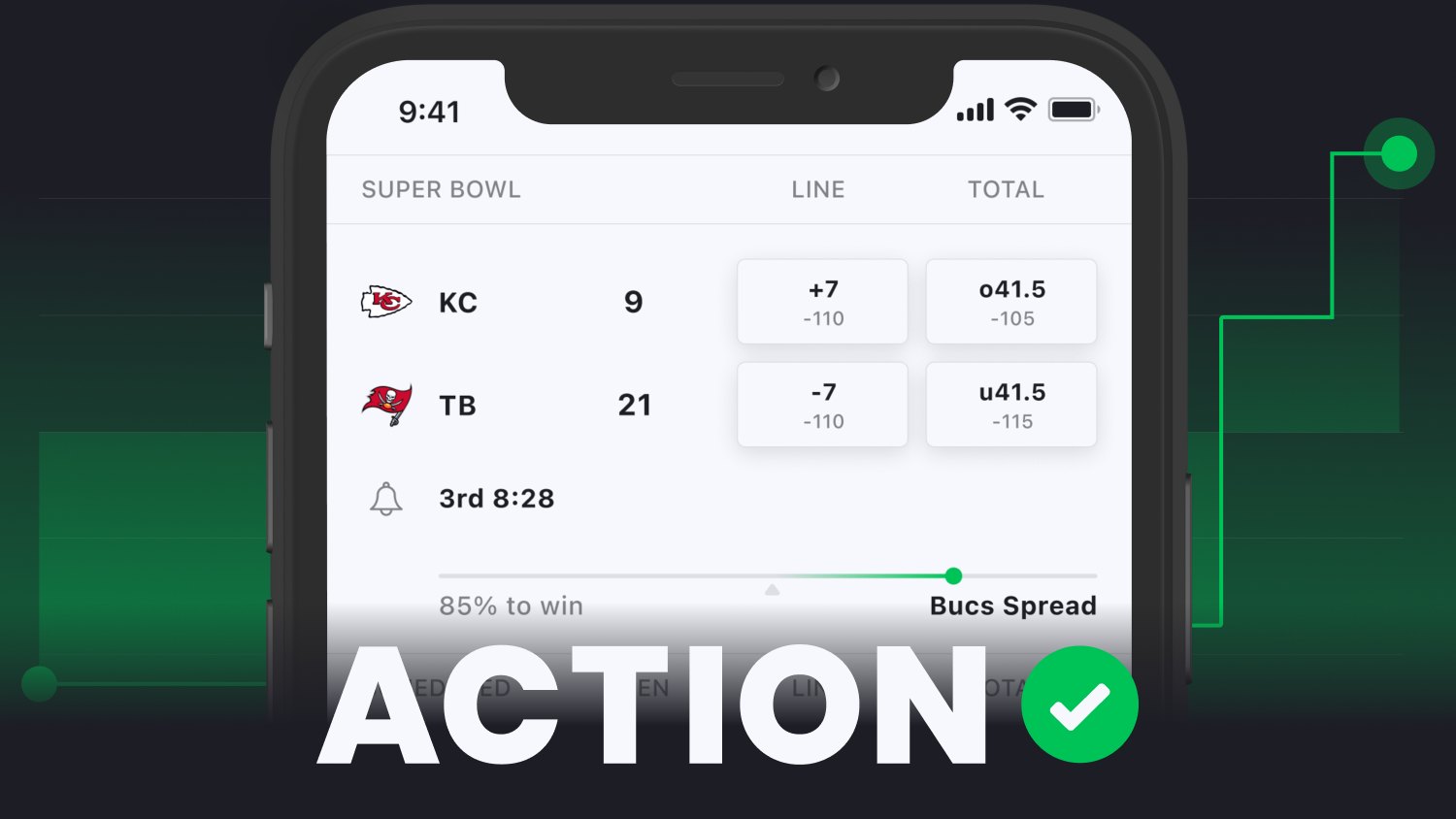

Critically, online implementation is uncertain at best for all members of “The Big Four.” Accounting for roughly 80 percent of the national handle, online wagering is key to the market’s continued growth; how this quartet handles mobile betting will have major impacts on American’s sports betting trajectory.

Without robust online options in most or all these states, which account for roughly one-third of the nation’s population, the U.S. may not reach industry projections as the world’s most lucrative sports betting market.

Here’s what to expect from this critical group in the next three years with nationwide legal sports betting:

California

Possible Retail Launch: 2022 or 2023

Online Access: Unlikely until 2024 or later

Status: California Native American gaming tribes are advancing a constitutional amendment that would permit retail sportsbooks on tribal lands. State officials are nearing final approval to place the referendum on an upcoming ballot, but it's unclear if it can be placed as part of the 2021 gubernatorial recall or if it must wait until the 2022 midterms.

If approved by voters, retail sportsbooks would likely launch in 2022 or 2023, depending on which preceding year hosts the ballot measure. Tribal gaming officials have hinted at launching online sportsbooks in the years to follow, but that remains uncertain. Dozens of California tribes depend on casinos as their community’s primary economic driver, and most prefer an in-person model intended to physically draw sports bettors to more lucrative gaming options and other amenities within their brick-and-mortar facilities.

If the tribes don’t embrace online sports betting, the state (and national) market potential dwindles significantly. Most tribes are in remote areas, and with retail not nearly as lucrative from a market perspective as online betting, the total handle could be a fraction of what a statewide mobile offering would bring.

In the meantime, the tribes are locked in a decades-long legal battle with state cardrooms, which, like the tribes, are politically influential and the single largest economic engine for many of their host communities. This could also delay or alter any retail or online sports betting, creating another question mark for California’s tribal-led legalization efforts.

Texas

Possible Launch: Not likely until 2025 or later

Online Access: Would likely be included with any sports betting approval

Status: Texas lawmakers this year renewed efforts for a generational update to their state’s long-standing gambling prohibitions, but despite backing from professional sports teams and casino industry leaders, it appears Lone Star State politics will be too much to overcome.

The legislature’s gaming proponents introduced several bills that would allow voters to approve casino gaming as well as online sports betting. None gained much traction. With the biannual session nearing its conclusion, it appears there’s not enough political will in Austin for any new gaming option despite increasingly favorable national and local attitudes toward legal gambling.

Spearheaded by Lt. Gov. Dan Patrick, who in his role has direct influence over the state Senate, conservative and anti-gambling lawmakers have derailed bipartisan gaming measures championed by fellow Republicans. Though casinos designed to attract Texans proliferate on the Oklahoma and Louisiana borders, the state’s policymakers remain unmoved in a state that hasn’t approved any notable gaming expansion since the lottery nearly three decades ago.

The legislature’s every-other-year meetings mean proponents will, barring an unforeseen special session, have to try again when the legislature reconvenes in 2023. That means a ballot measure wouldn’t likely come until the 2024 ballot.

In a state with only a handful of remote tribal casinos and horse tracks, any sports betting authorization will likely include online wagering. But getting there remains a political obstacle, one seemingly immovable for at least the next few years.

Florida

Possible Retail Launch: Late 2021 or early 2022

Online Access: Possible 2022, but subject to approval

Status: After years of negotiations, Florida elected officials and the state’s Seminole Tribe reached a deal that will expand the tribe’s gaming options, including online and retail sports betting. However, the new compact is still subject to state and federal approval, leaving components of the deal — and online wagering in particular — in jeopardy.

Republican Gov. Ron DeSantis and key lawmakers in the GOP-controlled legislature worked through the deal, meaning it should earn lawmakers’ approval during a special session to ratify the compact beginning next week. From there, the Department of the Interior would have to approve the agreement, but industry legal experts worry parts of the sweeping deal run afoul federal law.

The compact’s language says online wagers are considered to be placed on sovereign Seminole lands, allowing them to circumvent certain gambling prohibitions. States including New Jersey and New York have used similar rationale behind mobile sports betting operations for their commercial casinos, but the problem, analysts say, is that federal law does not give the same permission to regulated gaming tribes.

If the DOI upholds the language included in the federal statute and upheld in multiple court rulings, it would mean online betting is not permitted under the compact. The deal’s language would, however, allow certain impermissible clauses to be removed and still permit the compact to take effect.

All this means that retail sportsbooks at Seminole properties including Hardrock casinos in Tampa and South Florida could continue, with or without online betting. But online betting appears in doubt, a major potential blow to sports betting growth in a state as geographically vast as Florida.

Even if approved, online (and retail) sports betting would create a de facto monopoly under Seminole control. Florida could become the largest state with legal sports betting, but getting there — and reaching market potential many stakeholders had hoped for — may not come easily.

New York

Possible Retail Launch: Retail books already live

Online Access: Early 2022

New York technically approved retail wagering before PASPA’s repeal and brick-and-mortar sportsbooks at upstate commercial, as well as tribal casinos, take bets now. These have generated roughly $20 million in total handle, or a minuscule fraction of the total U.S. market.

That’s why the industry closely watched Gov. Andrew Cuomo’s January announcement in favor of online wagering and the months-long back-and-forth with the legislature over how such offerings would be conducted. Ultimately, Cuomo’s preferred limited-operator model prevailed over lawmakers’ competitive market vision, opening the door for mobile betting but creating many new questions.

Unlike all other states, New York’s mobile betting plan calls for bids for two “platform providers” which, between the two winning bidders, will subcontract out to at least four total sportsbook brands. The structure (and even eligibility) of the bidders won’t be fully known until state officials announce request for proposal details later this summer.

Then the winners won’t likely be revealed until sometime this fall. Policymakers hope the winners can launch by next year’s Super Bowl.

Cuomo is expecting winning bidders to give back around 50 percent of gross gaming revenues, roughly five times the national average, for rights to enter the limited market. The 2021 sports betting legislation requires four customer-facing sportsbook brands, but the tight profit potential in what is already a low-margin industry leaves little room for much more competition.

Possible additional legal challenges from losing bidders aside, New York online sports betting could launch by next year. But the path there is still uncertain and so too is the end result.