It was only fitting that Flutter held Wednesday’s Investor Day presentation at Cipriani, a famous New York catering hall replete with Renaissance-era ceiling paintings and massive arches that may remind bettors of The Venetian.

Flutter executives from around the world returned to Lower Manhattan this week, months after the company made its debut on the New York Stock Exchange. Flutter, the parent company of FanDuel Group, moved its primary listing to New York in May, months after its initial listing on the famed exchange. Flutter moved its primary listing to the NYSE from the London Stock Exchange in an effort to gain deeper access to capital markets in North America.

At Wednesday’s four-hour presentation, Flutter issued revised estimates for the long-term growth of the North American online gambling market. The company now expects the total addressable market (TAM) at maturity to hit $70 billion, approximately $63 billion of which is forecast to be in the U.S. The new U.S. forecast represents a 1.5x increase over Flutter’s previous estimates for the market. TAM estimates in the online sports betting space are generally measured in gross gaming revenue (GGR).

"With our unmatched scale, diversification and our global differentiator, The Flutter Edge, we have clear, sustainable, global advantages that will continue to drive sustainable growth and power our financial model with operating leverage building over time," said Flutter CEO Peter Jackson.

By 2030, Flutter projects a TAM of $368 billion in GGR throughout the regulated global gambling market.

Explosive Growth

Jackson was joined onstage by several executives on the Flutter leadership team, including CFO Rob Coldrake and FanDuel CEO Amy Howe.

A surge in betting markets offered by FanDuel has led to a shift into higher-margin parlay products. Over the last four years, Flutter has seen a 470% spike in betting markets per game, leading to a parlay mix that's 65% higher.

While some investors attribute FanDuel's high hold to its industry-leading parlay mix, the operator's superior pricing and risk-management capabilities are at the heart of its advantage over rivals, according to Barry Jonas, an analyst with Truist Securities. Holdcrunch, a data company that has worked with Truist in recent weeks, ranks FanDuel among the top operators in favorable pricing for customers.

By 2027, Flutter expects growth rates for existing state revenue to increase about 15-17% annually, or approximately $9.7 billion, at the midpoint. The company also forecasts a long-term sportsbook structural GGR margin of 16%, with estimates of 15% in 2027. For existing states, Flutter projects Adjusted EBITDA margin expansion of 13 percentage points by 2027 to approximately 25%.

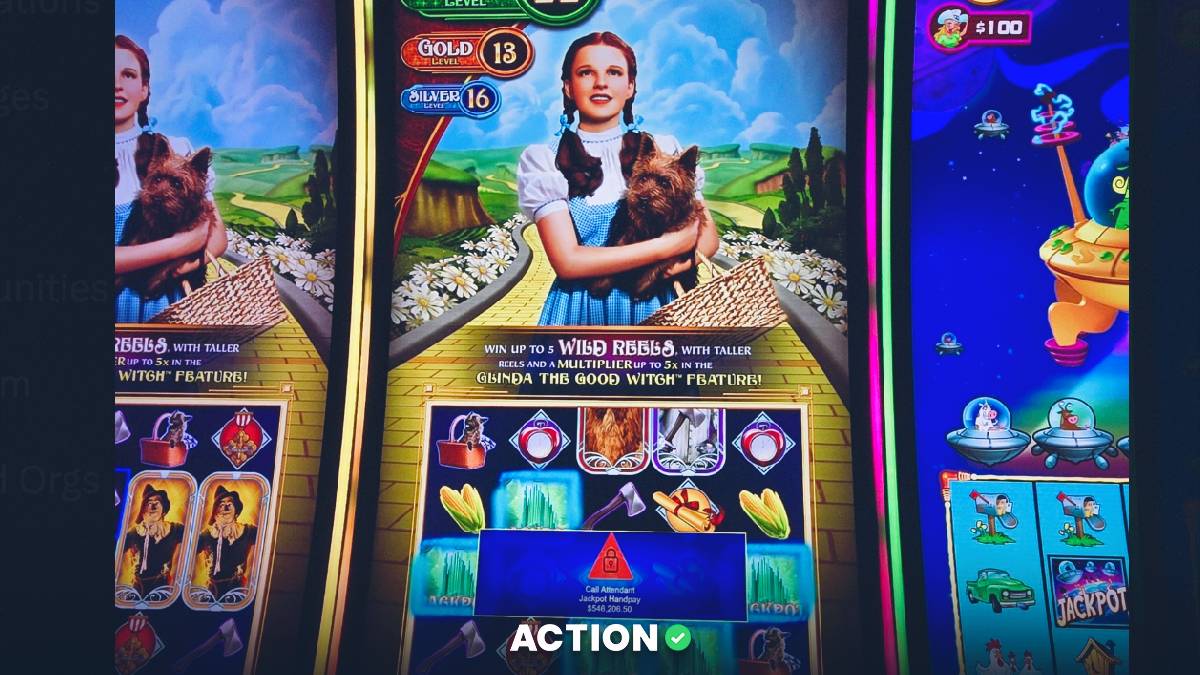

The crown jewel of the presentation centered on a new product under beta testing in Colorado. Dubbed "Your Way" parlays, the new pricing model increases a player's flexibility for multi-leg wagers, said FanDuel CMO Mike Raffensperger. In the past, bettors were unable to select certain markets for the multi-leg bets, whereas the model now increases a player's flexibility with same-game parlays (SGPs), he noted.

FanDuel showed investors a prop on Tua Tagovailoa's passing yards to showcase the product. Before a Week 2 tilt vs. the Bills, FanDuel set a -111 line for the Dolphins quarterback to throw for 268 yards or more. The product gives bettors the option of essentially setting their own lines through a slider feature. By swiping to the right, bettors received higher odds on Tua's passing total. If the quarterback threw for at least 400 yards, the ceiling on the wager, the corresponding odds increased to +290.

The product also enables a bettor to combine multiple props into a single SGP. Jordan Bender, an analyst with JMP Securities, described this feature as a potential game-changer. With personalization in mind, FanDuel will give bettors access to any type of wager, from a game outcome to a player prop, Bender wrote. The added flexibility may give FanDuel a "key competitive moat" in the online gaming industry, he emphasized.

Avoiding Complacency

Howe sees a considerable opportunity from U.S. states that have yet to legalize sports betting. As a result, FanDuel predicts that its market coverage could eventually reach 80% of the U.S. population. Howe cautioned that FanDuel will need to receive market access in at least two of the Big 3 states (California, Texas and Florida) to hit the projections.

For now, California and Texas, the nation's most populous states, do not offer legal sports betting. And while the Seminole Tribe has a monopoly on sports betting in the Sunshine State with its Hard Rock platform, commercial operators may be able to enter Florida through a referendum.

When asked about the biggest risks to the upside, Howe replied that FanDuel needs to avoid complacency despite its position as the market leader.

Flutter’s board also authorized a share buyback program of up to $5 billion, one that is expected to be deployed over the next three to four years. The program is expected to launch following Flutter’s third-quarter earnings presentation next month.

Shares of FanDuel parent Flutter Entertainment surged after the company unveiled a $5 billion share buyback.

CEO Peter Jackson joined us on set to discuss the company’s raised guidance, trends in sports gambling, and much more.@ContessaBrewer$FLUTpic.twitter.com/1fXPdKxIkq

— Squawk on the Street (@SquawkStreet) September 25, 2024

The timing and total number of shares repurchased will depend on a variety of factors, including legal requirements, price, and economic and market conditions, Flutter added. The guidance fits within Flutter’s 25-30% target range, which the company reiterated during its presentation.

Flutter shares jumped as much as 8% in Wednesday's session to an all-time high of $249.42 a share. After paring some of the gains on Wednesday afternoon, Flutter traded around $249 on Thursday morning, up 3% on the session.