In a landscape where traditional casino operations and online gambling platforms are evolving side by side, MGM Resorts has delivered reassuring news for the industry.

The numbers indicate that fears of online gambling overtaking traditional casinos might be overblown.

"We're encouraged by the strong demand we're seeing in the business so far in 2025, which positions us well for continued growth,” said Bill Hornbuckle, Chief Executive Officer & President of MGM Resorts International. "In fact, December was our highest convention booking month on record, and in January we saw revenue growth in our Las Vegas Strip Resorts and Regional Operations as well as strong future bookings,” he added.

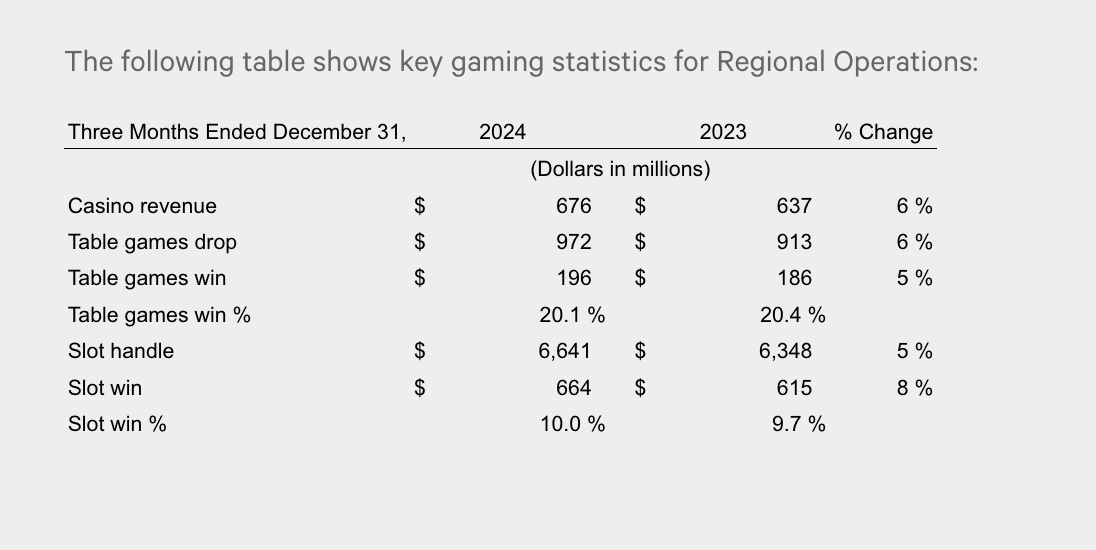

Robust Performance From MGM Regional Operations

MGM Resorts operates major properties like the Borgata in Atlantic City and MGM Grand in Detroit. Although its latest report does not detail each property's earnings, it distinguishes between Las Vegas Strip revenues and regional operations.

MGM Regional Operations generated $932 million in net revenues in the fourth quarter of 2024. That's up 7% from the $873 million earned in the same quarter the previous year. This increase was mainly due to higher casino revenues, partly because of the impact of a union strike at MGM Grand Detroit the previous year. Their Segment Adjusted EBITDAR (a measure of profitability) also rose, going from $233 million to $281 million, a 21% increase.

They also added casino influencer Brian Christopher to the fold, and he even hit a jackpot at the MGM in Detroit.

For the entire year, MGM Regional Operations' net revenues stayed steady at $3.7 billion, the same as the previous year. Their Segment Adjusted EBITDAR also remained at $1.1 billion. Michigan's online casinos made the state the second-largest market in the U.S. for 2024, just behind Pennsylvania, after setting a new record in December.

Las Vegas Strip and Overall Growth

Q4 also saw the Las Vegas Strip Resorts earn $2.2 billion, which is 6% less than the $2.4 billion they made in the same quarter the previous year. This drop happened mainly because casino and room revenues were lower, especially since the previous year had a boost from strong Formula 1 events. Additionally, their Segment Adjusted EBITDAR (a measure of profitability) fell from $864 million to $765 million, an 11% decrease.

For the entire year, Las Vegas Strip Resorts' net revenues remained steady at $8.8 billion, the same as the previous year. However, their Segment Adjusted EBITDAR decreased slightly by 3%, going from $3.2 billion to $3.1 billion.

MGM Digital Segment Sees Significant Growth

Turning to the digital domain, MGM Digital brought in $140 million in revenue during Q4, marking a 15% increase from the $122 million earned in the same period the previous year.

This growth was mainly due to expanding into new markets. However, they experienced a Segment Adjusted EBITDAR loss, which increased slightly to $22 million from a $20 million loss the previous year.

For the entire year, MGM Digital's revenue rose 28%, reaching $552 million compared to $432 million the previous year. Despite the revenue increase, their Segment Adjusted EBITDAR loss also grew, totaling $77 million this year, up from a $32 million loss last year.

“Our digital businesses are also on a positive trajectory, with our BetMGM venture in North America expected to be profitable this year and our global MGM Digital business integrating and scaling to address its significant $41 billion market opportunity," Hornbuckle said.

U.S. commercial gaming revenue achieved its fourth consecutive year of record-breaking growth.

Coexistence of Traditional and Online Casino Models

As MGM demonstrates, there appears to be room for both physical and online casino experiences to thrive concurrently in the U.S. market. With evidence mounting, including a favorable report from the American Gaming Association, the notion that online platforms will cannibalize traditional casinos seems increasingly unfounded.

The growth of iGaming does not appear to be at the expense of brick-and-mortar establishments. Instead, these domains are expanding simultaneously, catering to different segments of the gaming audience. The industry seems to be finding a balance, suggesting a symbiotic existence where both avenues can flourish.

As technology allows for more immersive and engaging online experiences, the human element intrinsic to a physical casino environment will ensure that traditional venues retain their allure.

MGM's latest financial results highlight that the coexistence of online and traditional gaming is not only viable but thriving. The numbers back the assertion that both sectors can push the industry to new heights together, offering players a diverse array of choices in their gambling experiences.

As further reports from competitors come in, the trajectory of a harmonious dual-market appears increasingly plausible.