Federal authorities have cracked down on a massive Ponzi scheme following the unsealing of an indictment and the arrest of a key player.

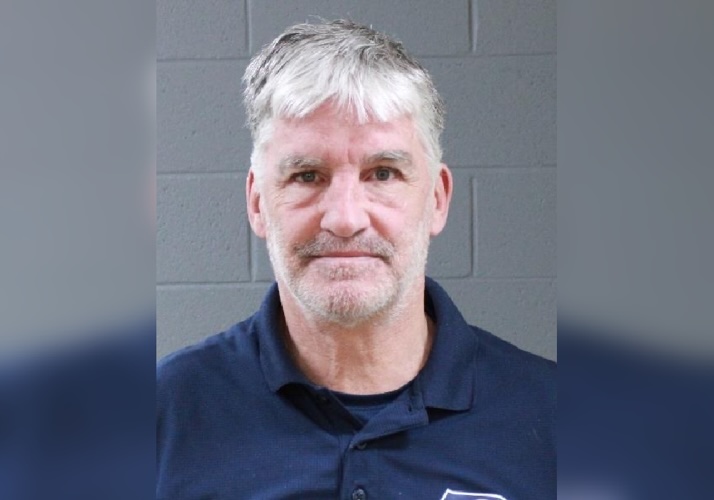

Thomas Paul Madden (66) of Washington City, Utah, stands accused of defrauding more than 200 investors out of over $23 million, with his business partner Jeremy Tyler Grabow (54) of Ladera Ranch, California, also charged.

The scheme, which began in September 2017, unraveled a web of deceit spun through two companies, Cascade IR, LLC and Savitar Systems LLC.

According to court documents, Madden misled investors through Cascade by falsely promising lucrative deals involving penny stocks. Instead of fulfilling these promises, he allegedly used the investment funds for Ponzi payments and personal expenses.

What is a Ponzi Scheme?

A Ponzi scheme is a financial scam where the organizer promises high returns with little risk, but doesn’t invest money in a legitimate business. Instead, they pay returns to earlier investors using the money from new investors. This creates an illusion that the scheme is profitable and encourages more people to invest.

For a Ponzi scheme to keep running, it needs a steady stream of new investors because it doesn’t make money through actual business activities. As new people invest, the organizer uses their money to pay previous investors, which keeps everyone believing the scheme is working. However, when the number of new investors slows down or too many investors try to get their money out, the scheme falls apart since there isn't enough new money to go around. When this happens, most people, especially those who invested later, lose their money.

Ponzi schemes are illegal, and authorities work hard to stop them and protect investors.

Investors Asked To Fund Casino Project That Never Was

The duo escalated their fraudulent activities in 2021 through Savitar Systems. Madden and Grabow convinced investors that Savitar was developing a large casino and resort project in Mexico. Promising high returns, they persuaded at least ten investors to part with over $2 million.

They even informed at least ten victims that they were collaborating with MGM Resorts, Mexican tour operator Cabo Paradise, data center company Datapod, and the Mexican Lottery on a project.

Yet, these glamorous projects never existed; the funds were reportedly funneled back into the Ponzi scheme.

Both Men Face Multiple Charges

Madden faces four counts of wire fraud, while both he and Grabow are charged with conspiracy to commit wire fraud and money laundering.

The legal proceedings are set to begin early next year. Madden had a court date scheduled for this week. Grabow is expected to appear on February 24.

If you think you are a victim in this case, information can be found on the U.S. Attorney’s Office Victim Witness Assistance page.