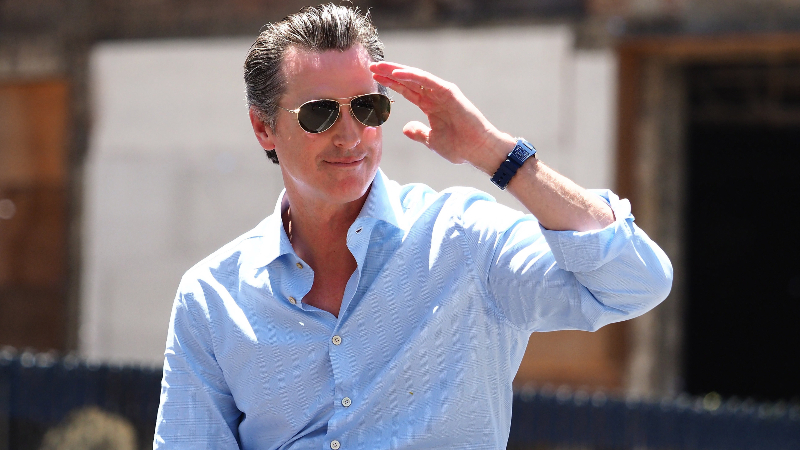

On Monday, California Governor Gavin Newsom signed a bill into law that will allow college athletes in the state to profit off their name, image and likeness.

The NCAA has been threatened many times with an assault on their amateurism model, but this is its greatest threat. A state law that would supersede the NCAA's current rules and agenda.

Colleges reap billions from student athletes but block them from earning a single dollar. That’s a bankrupt model.

I just signed the Fair Play to Pay Act with @KingJames — making CA the first state to allow student athletes to profit off their name, image, and likeness. pic.twitter.com/aWE9OL9r1v

— Gavin Newsom (@GavinNewsom) September 30, 2019

While I am not a fan of straight-up pay, given how it creates issues with students becoming employees, I have long advocated for college athletes to get a cut of their jersey sales and to be able to sign autographs.

The endorsement part, however, is a very slippery slope, because it is not, in any way, genuine.And much of the public arguing for the athletes here are unaware of its consequences.

There are 130 FBS schools and 353 Division I basketball schools. These rosters have 15,639 scholarship players.

Let’s say, for argument’s sake, that the top 50 programs could have two players in their market endorsing a total of two products each, and then the next 25 schools have one player in each sport endorsing one product. That’s 125 football players and 125 men's basketball players (250 total).

That’s 1.6% of the players.

NFL players who do endorsement deals in local markets have deals that range from free products to cash fees as high as $300,000.

Let’s be generous and call $100,000 the average deal for collegiate athletes.

So going back to our cohorts above:

- The 100 players from the top 50 schools would each get $200,000 per athlete in new-found cash — or $20 million total — that's not coming at the expense of the school.

- The 50 players from schools ranked 50-75 would each get $100,000 per athlete — or $5 million total

So we're talking about $25 million.

But here's the spoiler: That’s not what will happen.

What will happen?

The market will be flooded with more than $100 million paid directly to players, not because they have inherent value as an endorser, but because the endorsement will be used as a guise to allow boosters the ability to more freely pay recruits for their talents.

I’ll explain more later.

Andy Schwarz, an economist who consulted on the O’Bannon vs. NCAA case, and reminded me this morning that he helped write the California bill, has always advocated for free market capitalism. He explained the purpose of the bill to me on Twitter this morning.

"(The Bill) was meant to begin a process of giving athletes the same economic rights as the rest of America,” Schwarz wrote. “To go out into the market place and find economic partners, and to strike deals with them without imposition of the collusive market power of the NCAA.”

Schwarz continues:

"When a willing seller and a willing buyer meet in an arms-length transaction to set a price for an exchange of goods and services, both sides benefit and overall economic welfare is enhanced. Efforts to thwart such transaction harm the economy.”

Notice something about his first tweets at me? It doesn’t once mention endorsements. And that’s because Schwarz knows exactly what is going to happen. This has nothing to do with endorsements.

The Twitterverse asked me how boosters would actually be cheating in this scenario if players were allowed to be paid.

Well, it would still be cheating because the bill's intention (allowing endorsements for college athletes) would not be the principle purpose of what is created.

Here's how this will work in reality: Players who would normally have no market value as endorsers would land them anyway from companies owned by boosters.

Players won’t get paid $100,000 for an endorsement. The top athletes will get paid 15 times that. Why? Because it’s not about selling a product or service. It’s about creating a free market system under the premise of endorsements.

This, unlike every other endorsement deal, would have nothing to do with a billboard or the return on investment for a business. It has to do with the return on investment for the booster as a fan.

Economists will say, well that’s their market value. No, it isn’t. That’s their market value for free market capitalism. That’s their market for being recruited. That isn’t their market value for endorsements once they land in town.

By Twitter sentiment alone, it seems like more and more people are in favor of that kind of free market capitalism. While I’m not one of those people, I see that side.

But I know there's a whole group of people who are for college athletes getting paid for endorsements, who do not believe in free market capitalism and who are getting hoodwinked into thinking this is actually an endorsement play.

Here’s your warning: It’s not.