Falling revenues, rising costs and a looming budget deficit could, finally, compel New York online sports betting, two lawmakers said during a gaming industry conference Monday.

State Sen. Joseph Addabbo and Assemblyman J. Gary Pretlow, the leading mobile sports betting advocates in their respective chambers, reignited hopes on Tuesday that online wagering legislation could pass out of the legislature, possibly as early as this year. With a multibillion-dollar shortfall pending, the lawmakers said their fellow elected officials will be more supportive than ever for any new revenue source.

“My colleagues know that we need the money and there will be revenue deficiencies next year compared to this year, so I don’t think it’s a hard sell for the cause of tens of millions of additional revenues,” Pretlow said during an industry conference Tuesday. “They can’t thumb their nose at it.”

Pretlow and Addabbo have at times been both sports betting champions and cheerleaders, optimistically touting the likelihood of statewide mobile wagering even as it gained little traction in successive legislative sessions. They said the state’s COVID-19 pandemic response could be the key to finally passing legal online sports betting.

Pretlow said Tuesday that Assembly Speaker Carl Heastie plans to include sports betting in a revenue bill up for discussion this month. Speaking during the Betting on Sports American Digital conference, Pretlow said both the Assembly and Senate will include sports betting initiatives in their respective 2021 budget proposals if not passed during the revenue bill this year.

If sports betting is not taken up during the revenue bill discussion in December, elected officials will have three months to deliberate on what will surely be a drastically curtailed budget ahead of the legally required April 1 ratification deadline. Gov. Andrew Cuomo, who has so far not included mobile sports betting in his upcoming budget proposals, announced a planned $10 billion spending cut due to COVID-19, and Pretlow said Tuesday that could include up to a 20% reduction in education funding.

“This could go some way, I wouldn’t even say a long way, but it could go some way back to our education system and providing funding for our young people,” Pretlow said.

Political Difficulties for New York

The latest hopeful projection goes against the entrenched legislative resistance failures and, more importantly, Cuomo's seemingly intractable mobile sports betting reluctance.

In response to the Great Recession and the state’s last significant economic downturn 10 years ago, Cuomo pushed legislation that legalized four upstate casinos, as well as their rights to take retail sports bets. Now, he has seemed disinclined to support expanded gaming in the face of the state’s latest economic calamity.

Cuomo has dismissed sports betting as an insignificant revenue opportunity for the state, despite the billions wagered annually in New Jersey, much of which comes from New Yorkers. Potentially more lucrative digital gaming options, such as online casino gaming or real money poker, have likewise garnered little interest from the executive mansion.

Despite his recalcitrance, Addabbo said lawmakers in the Democratic-controlled Legislature want to avoid overriding a possible veto from a fellow Democrat in Cuomo should the legislature approve mobile wagering. Instead, backers are still holding hopes for a collaboration between legislators and the governor.

“Once you override a veto, the governor is not going to look at sports betting very favorably at a time when we really need the revenue and educational funding,” Addabbo said.

An intraparty veto override is already difficult politically. And though Democrats have supermajorities in both chambers, meaning they could override any veto without a single Republican vote, the legislature attempted only one such override in Cuomo’s first eight years in office.

As supporters in the legislature try to sway Cuomo, they still have to settle on key legislative differences between themselves. This includes critical regulatory measures that are difficult to pass in the most hospitable of situations, such as taxes, operator access and license accessibility.

Even Addabbo and Pretlow are divided over the number of online licenses, or “skins,” for retail sports betting partners.

Addabbo, as well as the state’s casinos, largely support a single-skin model. The senator said Tuesday that a lone skin for each casino is better than no skin, and the smaller step forward had a better chance of currying Cuomo’s favor while opening the door for further expansion in the future. The casinos support this proposal, ostensibly to minimize competition.

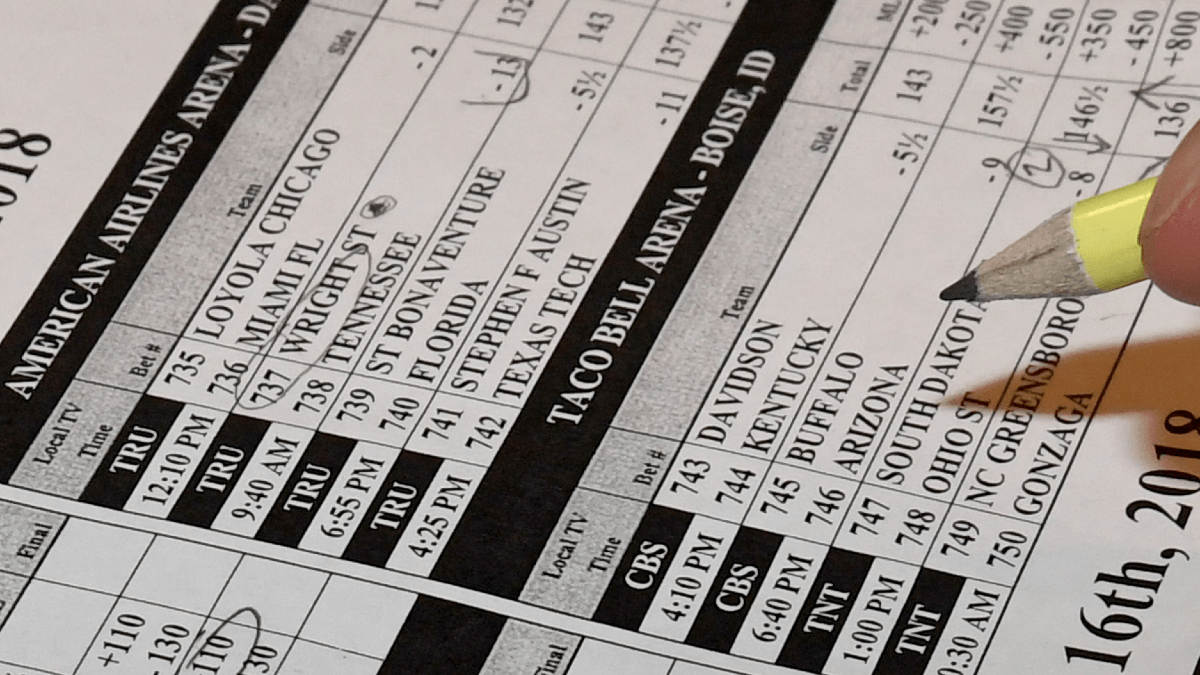

Pretlow, and the industry at large, favors a multi-skin model. Neighboring New Jersey, which set the single-month handle record with $803 million in October 2020, has been lauded as a model sports betting market, partially because of its widespread operator access.

New York would surely garner interest from all top sports betting companies, but a single-skin model could shut out some top operators, hindering the legal market’s potential and possibly even forcing some New Yorker back across the Hudson to wager with their preferred sportsbook. Even in New Jersey, hundreds of millions of dollars are wagered with offshore sites or unlicensed bookmakers, a scenario that would only be exacerbated with a limited New York market.

Possible New York Sports Betting Impact

The latest positive spin on New York’s mobile sports betting hopes is nothing new from the legislature’s two biggest supporters, but any Empire State wagering developments are big news, despite the seemingly quixotic quest for legalization.

New York's large population, iconic sports franchise and unique role in American media and culture could make it the new epicenter of legal U.S. sports betting. For now, its fledgling brick-and-mortar sportsbooks are a relative afterthought in the larger U.S. market.

New York voters technically approved sports betting as part of the 2013 constitutional amendment backed by Cuomo that created the upstate commercial casinos. Wagering began at these facilities, as well as several Native American casinos, in 2019 after the Supreme Court struck down the federal wagering ban and allowed individual states to take bets.

During that time, New York has reported only about $13.5 million in total handle despite its massive population. The handful of commercial and tribal casinos are in predominantly rural areas, most of which are a multiple-hour drive from the New York City metro area.

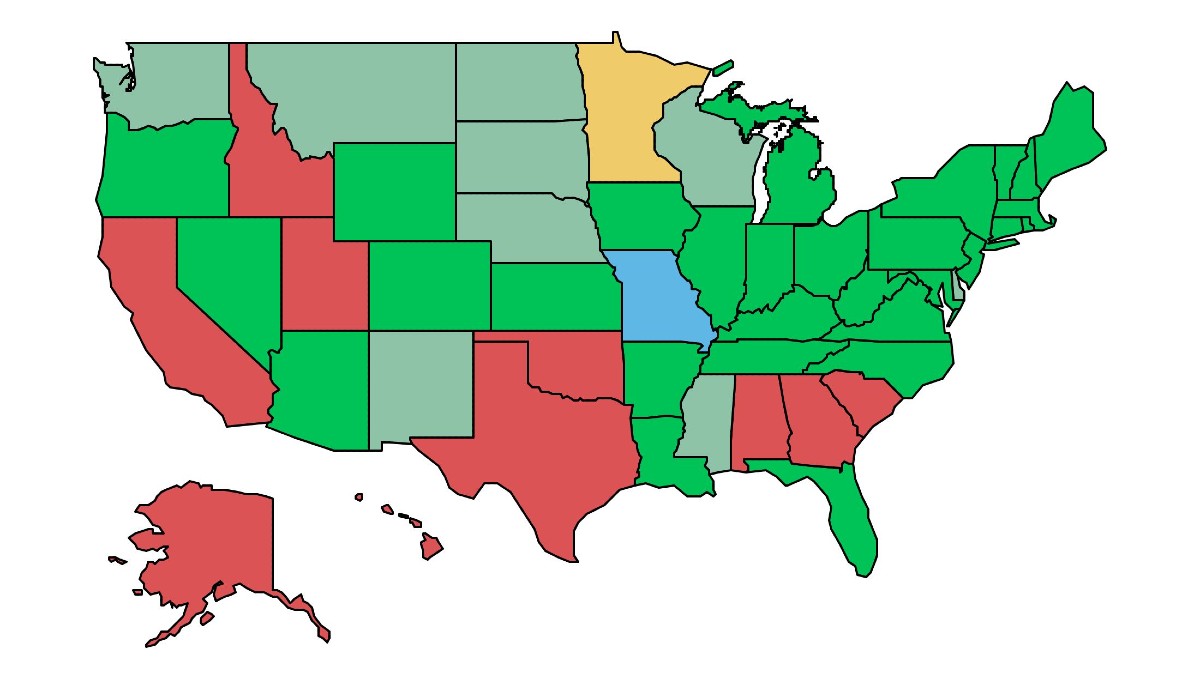

Conversely, a statewide mobile market would almost assuredly be the nation’s largest. It’s population (roughly 20 million) trails only California, Texas and Florida, none of which appear poised to legalize mobile sports betting in the next few years.

Depending on its legislation, New York could easily see several billion dollars in annual handle and several hundred million in tax revenues, a small portion of its 12-figure yearly budget. Still, many New York elected officials believe the state is in no position to pass up new revenues, especially ones as relatively painless as online sports betting.

“We’ve pushed really hard for mobile sports betting to be enacted in New York State,” Addabbo said. “We’re still optimistic we can get it done.”