The landscape of the gaming industry is rapidly evolving, with legal online casinos becoming a significant contributor.

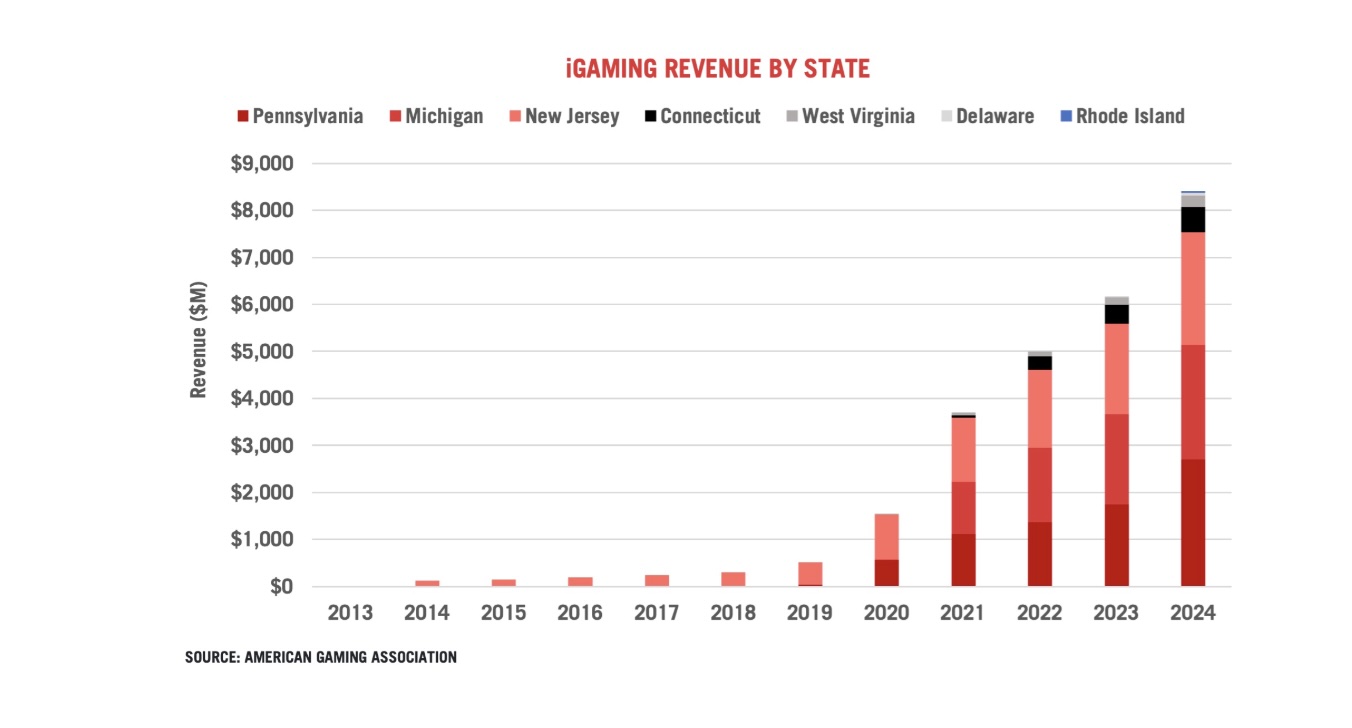

The latest report from the American Gaming Association (AGA) reveals that Rhode Island’s entry into the market, fueled a landmark for the U.S. iGaming industry in 2024. Online gaming revenue, which includes iGaming and online sports betting, grew by 24.6% to $21.54 billion—a new record.

By the end of the year, combined revenue across seven active states (excluding Nevada's poker-only market) had reached $8.41 billion. An increase of almost 29% increase from the previous year.

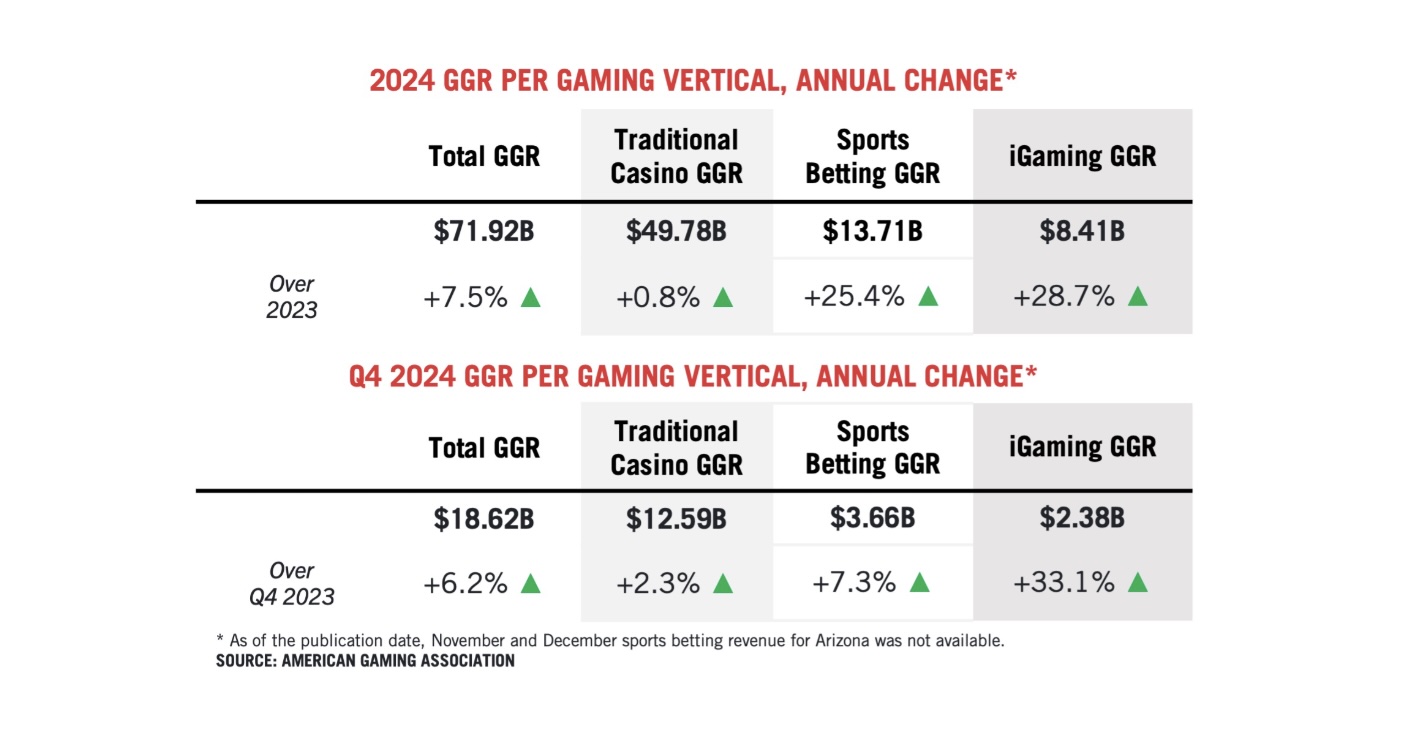

The AGA’s report found that (overall) the commercial gaming industry generated nearly $72 billion last year. This marks a 7.5% increase over the previous high of $66.5 billion set in 2023 and represents the fourth consecutive year of record-breaking revenue.

Pennsylvania Online Casino Leads the iGaming Pack

The six established iGaming markets continued their upward trajectory, each achieving new annual revenue records.

Growth rates varied, but Pennsylvania remains the biggest player in the U.S. iGaming scene, generating an impressive $2.71 billion in annual revenue. This figure represents a 28.5% jump from 2023, further solidifying its position as the leading market.

Not far behind, Michigan online casinos and New Jersey both surpassed the $2 billion mark, setting new records as the second and third largest markets respectively. New Jersey saw a 24.1% increase and Delaware online casinos experienced a staggering 345% jump compared to last year.

But what stands out is that all six established iGaming markets saw new revenue records.

Online Gambling Driving Revenue Growth Overall

The iGaming sector closed out 2024 on a high note, setting a new quarterly revenue record of $2.38 billion in the final quarter. Some even called November "the perfect storm" for gaming revenue. This end-of-year figure represents a 33.1% increase from Q4 2023.

These impressive numbers underscore the expanding influence and growing popularity of iGaming across the United States.

iGaming revenue grew faster last year, while sports betting's growth slowed down. Now, in 13 states, including Michigan, New Jersey, and Pennsylvania, online gaming (both sports and casino) generates the most commercial revenue.

“In 2024, Americans embraced the diverse legal gaming options available to them—whether in casinos, at sportsbooks, or online—leading to another record-setting year for our industry,” said AGA President and CEO Bill Miller. “As we build on this success, the AGA remains committed to fostering additional growth that benefits consumers, operators, and communities alike.”

The commercial gaming industry contributed more money to state and local governments than ever before in 2024. Throughout the year, commercial gaming operators paid nearly $16 billion in gaming taxes, which is an 8.5 percent increase from the previous year.

Traditional Casinos Also Experience Increases

Revenue from land-based gaming, like casino slots, table games, and retail sports betting, reached $50.32 billion, just a 0.6% increase from 2023.

Traditional casino games, including slot machines and table games, brought in $49.78 billion in 2024. This represents an increase of 0.82% from the previous year. Notably, 12 out of 27 state markets saw new records for traditional gaming revenue.

"The ongoing growth of legal gaming benefits the entire industry, consumers, and surrounding communities," said Miller. He pointed out that gaming revenue supports jobs, investment, and economic expansion, highlighting why the industry's legal expansion is vital.

Online Casino Debate To Continue in 2025

Opponents of iGaming legalization might argue that the lower growth rate for traditional casinos and the fact that iGaming made up a record 30% of total commercial gaming revenue in 2024 prove that iGaming is taking business away from physical casinos. However, the trend indicates that fears about iGaming stealing customers from brick-and-mortar casinos appear to be exaggerated.

Evidence increasingly suggests that the US gambling industry can support both in-person and online casino play, with significant growth driven by iGaming.

With more states on the verge of legalizing online casinos, including New York,Ohio,Indiana and Virginia, numbers are poised to go up even more in 2025.