The American Gaming Association (AGA) forecasts that U.S. commercial gaming revenue will surpass $67 billion in 2024, marking the fourth consecutive year of record-breaking growth.

From January to September, revenues exceeded $53 billion, representing an 8% increase compared to the previous year.

The third quarter of 2024 saw commercial gaming revenue reach an unprecedented $17.71 billion, and it does not appear to be slowing down.

In October, U.S. commercial gaming revenue grew by 1.9% from the same month in 2023, marking the industry's 44th straight month of annual growth. According to AGA data compiled from state regulators, revenue from traditional casino games, sports betting, and iGaming totaled $5.81 billion, setting a new monthly record for October.

But it's online casino games and sports betting that are fueling the industry at the moment.

Online Gaming Propelling Industry Growth

Online gaming led the growth, as iGaming revenue jumped 30.3% to $2.08 billion, and sports betting revenue climbed 42.4% to $3.24 billion. Together, online gaming made up 29% of the industry's total revenue.

In October, online gaming kept growing, as revenue from sports betting and online casino games went up by 5.9% compared to last year, reaching $1.73 billion.

States With Legalized Online Casinos See Massive Bump

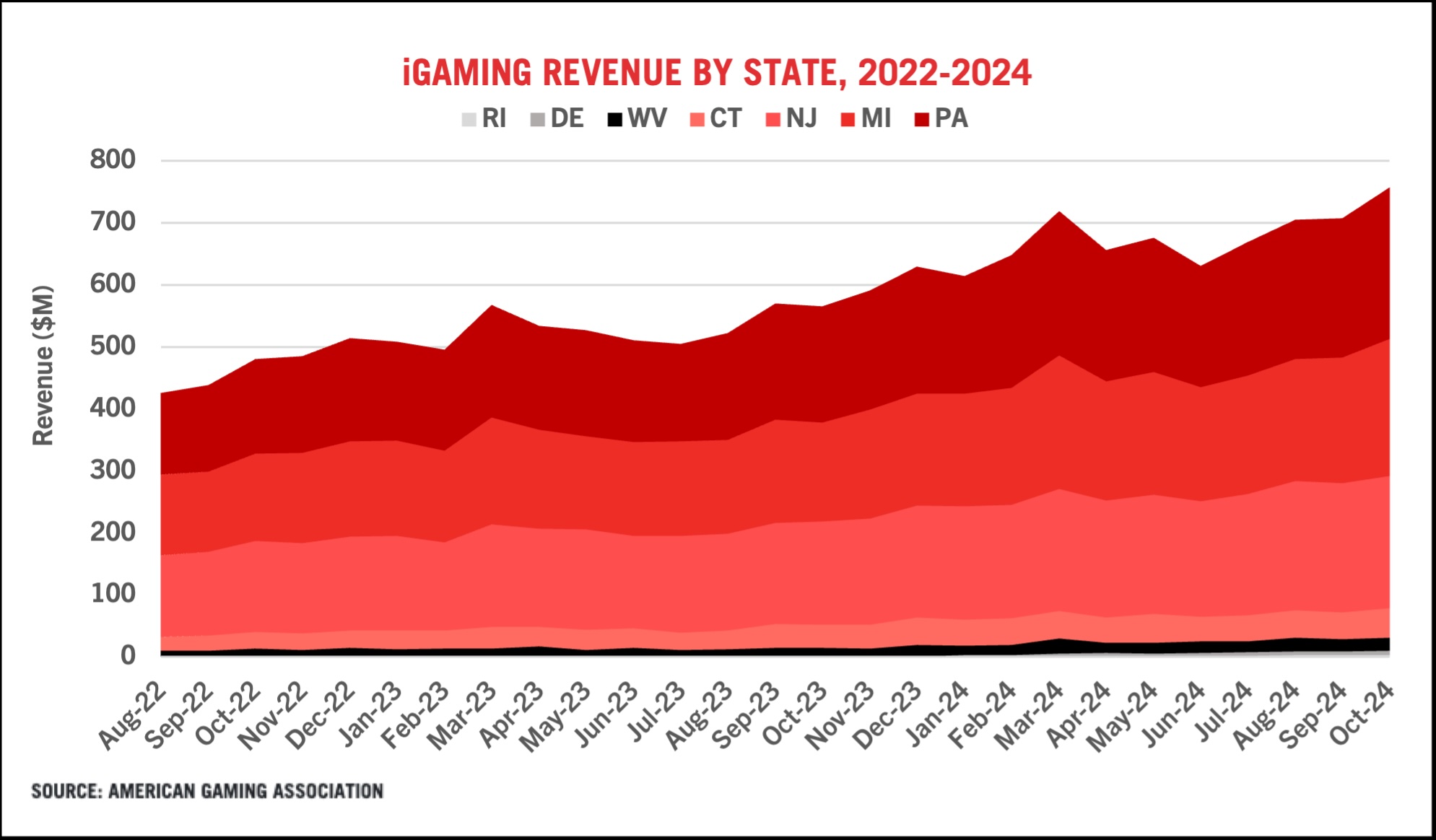

The iGaming sector continued to grow strongly in October, with revenue rising 34% from last year to $758 million across seven active states.

Revenue climbed in all six states where online casinos were operating in October 2023. Delaware, in particular, saw a massive increase of 586% due to a recent change in its iGaming partner.

From the beginning of the year through October, iGaming revenue hit $6.8 billion, up 28% compared to the same period last year

Traditional Casinos See Slight Increase in October

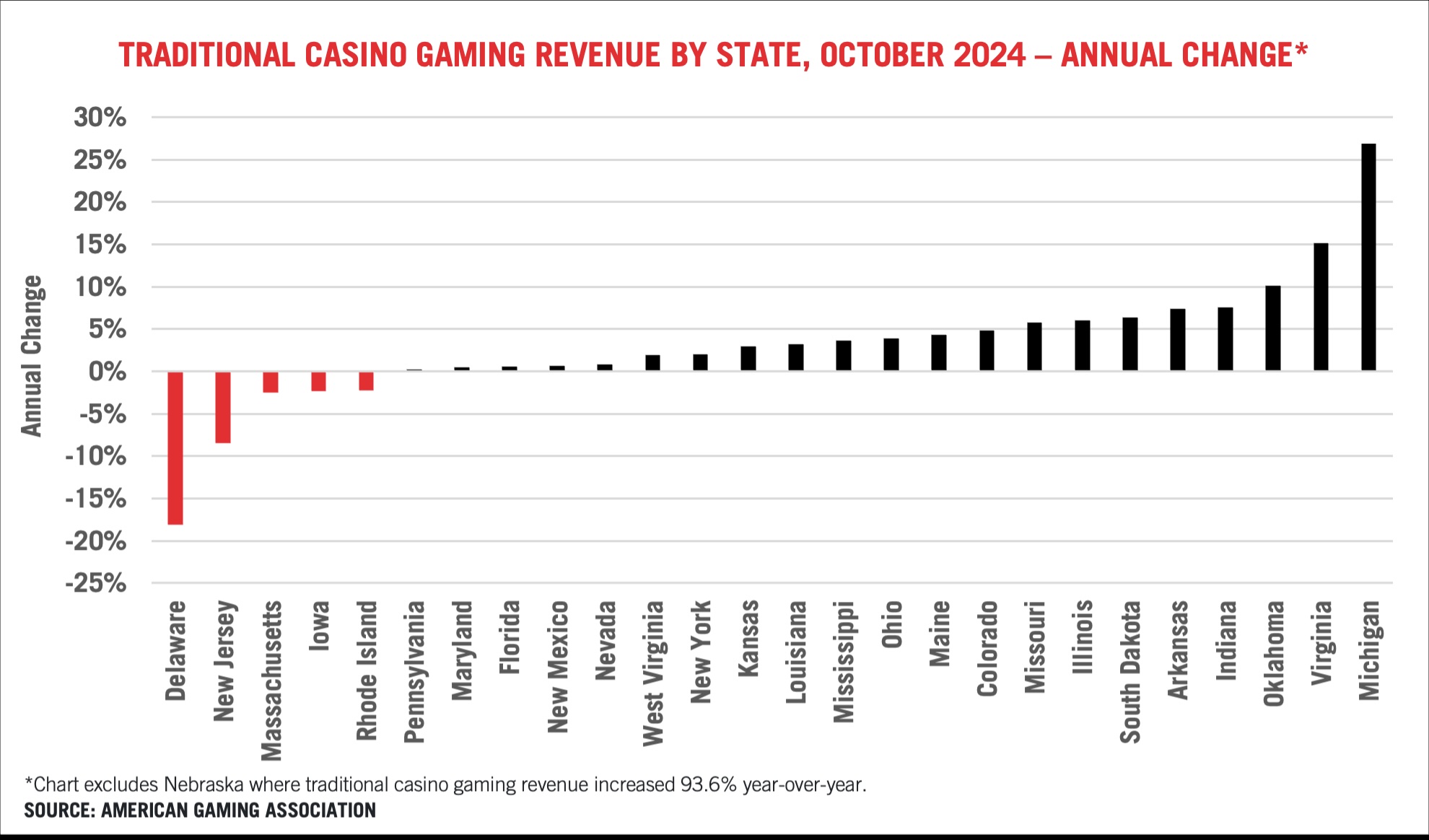

Traditional gaming revenue bounced back in October, rising over 2% after dropping by more than 1% in September. Out of the 27 states with traditional gaming, 22 reported increases in brick-and-mortar revenue compared to October 2023.

By the end of October, revenue from casino slot machines and table games reached $41.2 billion, slightly ahead by 0.5% compared to the same period in 2023. Notably, Nebraska continues to benefit from the reopening of WarHorse Casino in mid-August, while Delaware faced tough comparisons against a very strong October in 2023.

Traditional casino slot machines and table games continue to comprise the bulk of revenue for the U.S. commercial gaming industry.

The AGA's Commercial Gaming Revenue Tracker offers detailed insights into the financial performance of the U.S. commercial gaming industry, both on a state-by-state and national level.

Miller Sees Bigger Things Ahead in 2025

Reflecting on this pivotal year, American Gaming Association President Bill Miller highlighted the remarkable growth and innovation that have become hallmarks of the industry. "We saw tremendous growth and innovation as the industry worked to create new experiences and offerings for the ever-evolving consumer," Miller remarked in a LinkedIn post.

One of the key insights from 2024 is the bipartisan support Americans have shown for the gaming industry, which Miller sees as a vital asset. "Americans’ views towards the gaming industry transcend party lines, providing us with a unique opportunity to advocate without partisan constraints while keeping the gaming industry and our customers’ interests at the forefront," he said.

This widespread acceptance opens doors for further advocacy efforts without the usual hurdles posed by political affiliations.

In terms of responsible gaming, the industry has taken significant strides forward. "This year we embraced innovative ways to advance responsible gaming," Miller noted. He anticipates that the coming year will bring even more progress by harnessing consumer insights and cutting-edge research to expand the reach and impact of these initiatives.

The demographic shift in the gaming industry is also noteworthy, as the average age of casino visitors has decreased from 50 to 42. "Younger generations are embracing our industry. We must continue our efforts to unleash innovation," said Miller. The industry’s ability to adapt to and capitalize on this younger, diverse customer base will be crucial in maintaining its momentum.

Ultimately, Miller believes the industry's strength lies in its ability to collaborate, adapt, and provide world-class experiences. "2024 brought our industry much success, and I look forward to seeing everything in store for the gaming industry in 2025," he concluded.

With these advancements in sight, the future of the commercial gaming industry appears to be prosperous.