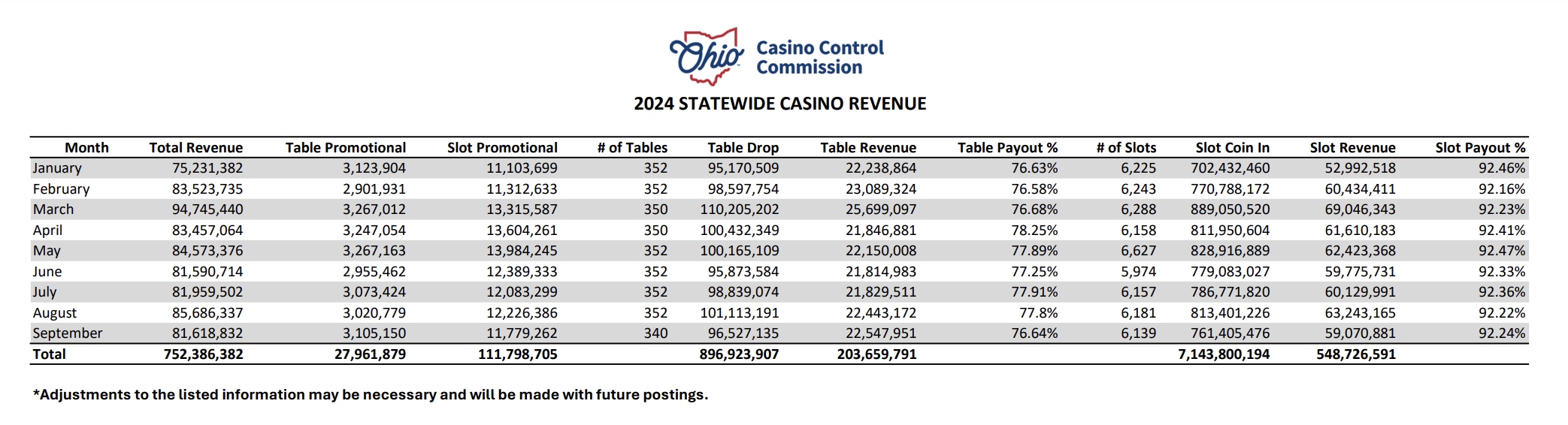

Ohio's latest report on casino and racino revenue contains some good news and some bad news. While September's numbers show a decline compared to the previous month and remained steady year-over-year, racinos performed relatively well compared to last September.

Ohio’s 11 casinos and racinos brought in approximately $191 million in gambling revenue in September, a $13 million decrease from August's record-setting number of just over $204 million. The previous record was set in August 2022, at $196 million.

In September 2023, these casinos and racinos reported about $190 million in revenue, according to the Ohio Casino Control and Lottery commissions.

The four casinos made almost $82 million in gambling revenue in September. This is about a $1 million decrease from September last year.

What’s the Difference Between Casinos and Racinos?

Ohio’s seven racinos are gambling venues at horse racetracks offering only slot machines. They do not offer table games. An example is MGM Northfield Park.

Racinos are regulated by the Ohio Lottery Commission. In 2009, Ohio voters approved a constitutional amendment permitting four casinos in the state; an executive order allows Ohio’s seven racetracks to operate video lottery terminals (VLTs).

Casinos, on the other hand, have no race track and offer table games. They do share one similarity with racinos (other than slot machines). They are also regulated by the Ohio Casino Control Commission.

Revenue at Ohio Racinos Up From Last Year

Ohio racinos made about $109 million in September. This is an increase from the $107 million they made in September last year. The Lottery Commission's totals do not account for bets placed on horse races, or sports betting figures.

In the first eight months of 2024, Ohio's gambling establishments have reported roughly almost $2 billion in revenue, showing no significant change compared to the same period last year.

Ohio Gaming Tax Rate 33%

The gross casino revenue tax is a daily levy of 33% on casino operators' gross revenue. This revenue encompasses all funds exchanged by patrons for chips, tokens, tickets, electronic cards, or similar items, minus the winnings paid out.

Here's an overview of Ohio's Gaming Taxation:

Casino Revenue Tax:

- A tax rate of 33% is levied on all gross casino revenue

Video Lottery Terminal (VLT) Taxation:

Revenue distribution:

- 66.5% to racinos as commission

- 33.5% to the Ohio Lottery

Distribution of Casino Tax Proceeds:

- 51% allocated to the 88 counties based on population

- 34% allocated to the 88 counties based on public school district student populations

- 5% to the host city of the casino

- 3% to the Ohio Casino Control Commission

- 3% to the Ohio State Racing Commission

- 2% to a state law enforcement training fund

- 2% to a state problem gambling and addiction fund

All proceeds distributed by the Ohio Lottery support education in Ohio.