At some point, you have to start to wonder, when will it end?

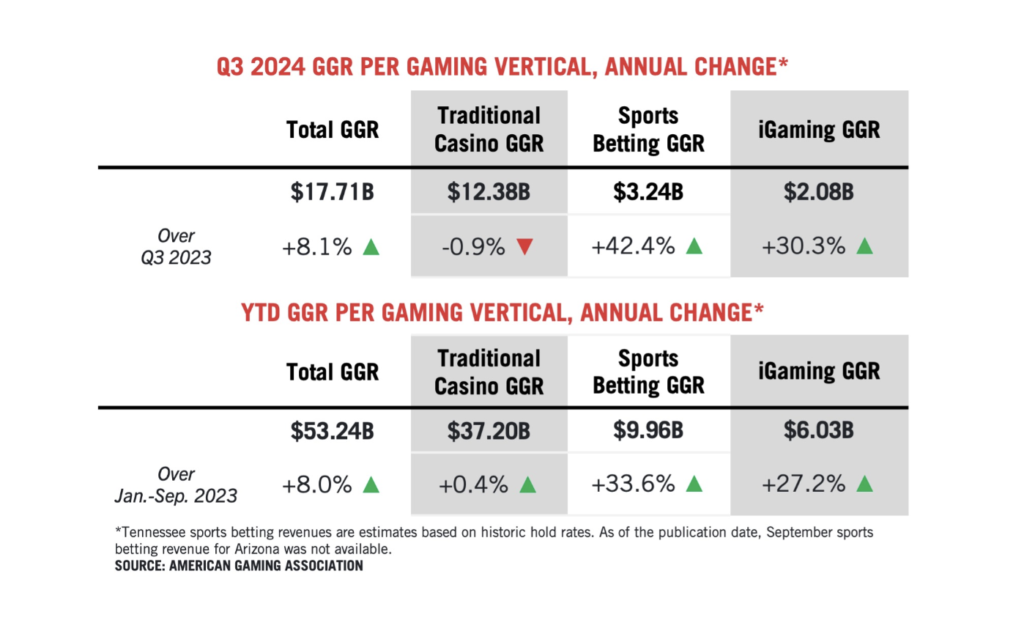

After a record-breaking second quarter, the U.S. commercial gaming industry continued to thrive in the third quarter, earning a total of $17.71 billion.

This was the highest revenue ever recorded for a third quarter, according to the American Gaming Association (AGA).

The industry has now seen revenue growth for 15 consecutive quarters, with September marking the 43rd month in a row of year-over-year revenue increases. Sports betting and online gaming are major factors driving this growth.

Casino Gaming Records Continue to Fall in 2024

By the end of September, nationwide commercial gaming revenue had reached $53.24 billion, marking an 8.0 percent increase over 2023 and setting the industry on course for a fourth consecutive record-breaking revenue year.

According to the AGA’s report, here’s how each facet of the gaming industry broke down in Q3:

- Traditional Gaming: Traditional brick-and-mortar casino gaming generated quarterly revenue of $12.38 billion, a contraction of 0.9 percent year-over-year.

- Legal Sports Betting: Americans legally wagered $30.3 billion on sports, generating $3.24 billion in quarterly revenue (+42.4% YoY). Recent market launches in Kentucky, Maine, North Carolina, and Vermont contributed to this growth.

- iGaming: iGaming generated $2.08 billion in revenue, marking a 30.3 percent year-over-year increase.

Notably, in October, online gaming revenue in New Jersey surpassed live casino revenue for the first time.

In the third quarter of 2024, 37 states and the District of Columbia had active commercial gaming markets, offering casino gaming, sports betting, and iGaming. iGaming is only legal in seven states: New Jersey, Delaware, West Virginia, Pennsylvania, Michigan, Connecticut, and Rhode Island.

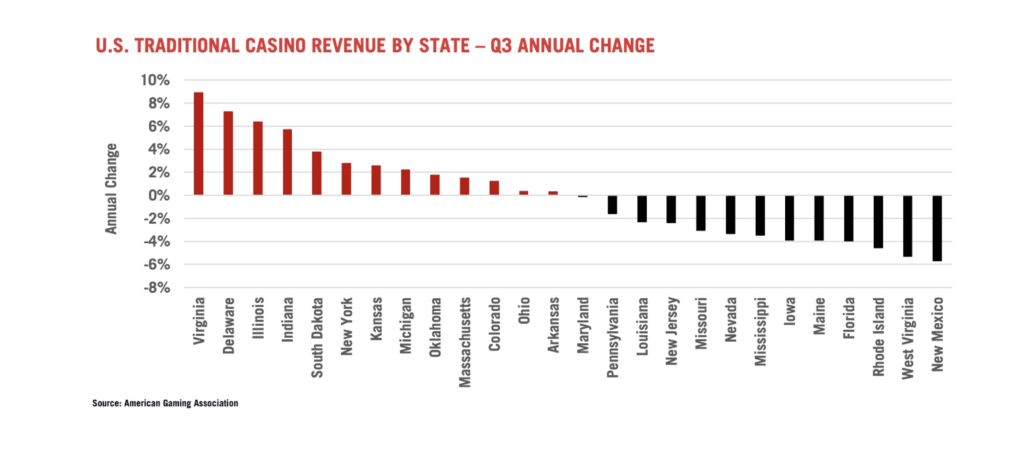

Top Performing States for Casino Revenue

Nebraska, Virginia, Delaware, and Illinois saw the highest increases in traditional casino revenue in the third quarter, averaging 8.5%.

These gains were largely driven by new casino openings. Here's a breakdown of some of the top-performing states.

- Nebraska: Omaha opened WarHorse Casino in August, which helped Nebraska achieve a growth in gaming revenue of nearly 75%.

- Delaware: Returning to 24/7 operations increased Delaware's casino revenue by nearly 8%. Delaware Park Casino will open an outdoor gaming area in spring 2025.

- Virginia: Rivers Casino Portsmouth led to Virginia achieving a 9% growth in casino revenue. Future growth looks promising with the opening of Caesars Virginia and upcoming casinos in Norfolk and Petersburg.

- Illinois: The opening of Bally’s Chicago Casino boosted Illinois' revenue by over 6%. Wind Creek Casino Southland just opened and will contribute to future growth.

- Indiana: Terre Haute Casino Resort opened in April, driving nearly 6% revenue growth.

- South Dakota: Annual revenue grew by almost 4%.

- New York: While new downstate casino licenses are being discussed, upstate casinos saw a 3% growth, with August revenue reaching more than $62 million.

- Kansas: The state's four casinos achieved almost 3% revenue growth in Q3.

- Michigan: Detroit's three casinos saw over 2% growth, with MGM Grand Detroit and Hollywood Casino leading the way.

- Oklahoma: Oklahoma's commercial casinos saw a 2% growth in Q3 revenue.

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and nationwide insight into the U.S. commercial gaming industry’s financial performance.

Nearly $4 Billion in Gaming Taxes Paid

State and local governments in gaming states gained $3.79 billion from gaming taxes in the third quarter, marking an 8.9% increase from the previous year.

This amount reflects taxes directly tied to gaming revenues and does not include annual fees, federal sports betting taxes, or other taxes like income and sales taxes paid by the gaming industry.

Most states saw their revenues rise, as 29 out of 35 operational commercial gaming areas reported higher third-quarter earnings compared to 2023.