Interest rates have been at the forefront of the political discourse for much of Donald Trump's presidency, and especially in the last few weeks. Trump called for Federal Reserve chairman Jerome Powell's firing last week, but then backtracked and said he had no intention of ever firing him.

Trump still believes it's the right time to lower interest rates. But prediction markets don't think it will happen in May.

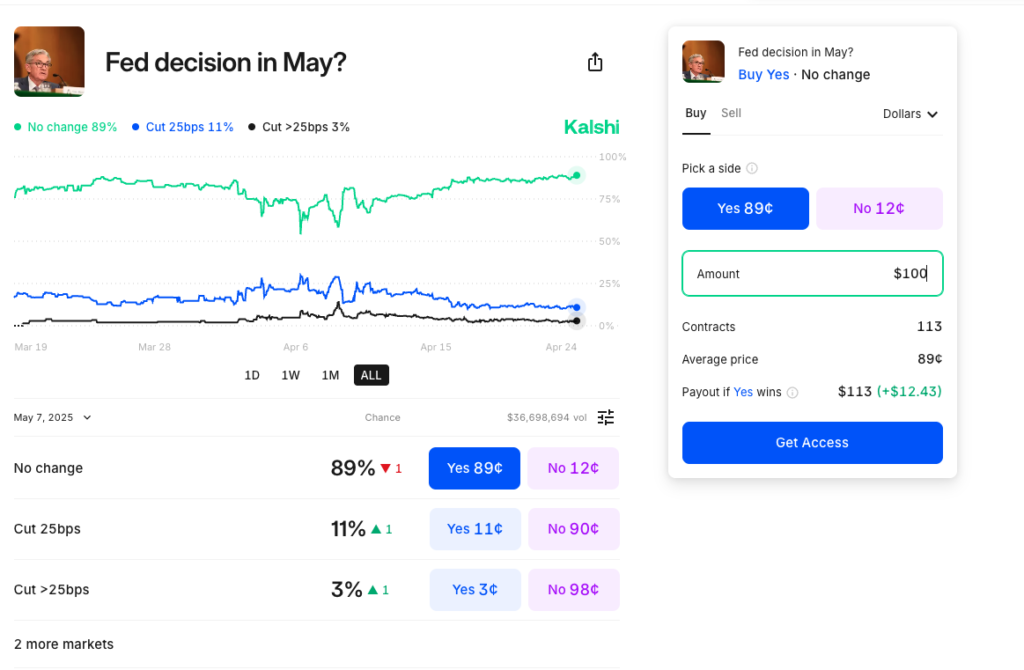

Traders at Kalshi, a prediction market available in most U.S. states, say there's an 89% chance that there will be no change in interest rates in May. There's an 11% chance the Fed will cut between 0-25 basis points, and a 3% chance the cut will be greater than 25 basis points. Kalshi traders give a rate increase almost a 0% chance.

Kalshi itself isn't the one setting these prices — it's a prediction market where the money traded by users dictates the prices. You can trade a huge variety of markets at Kalshi related to sports, politics, the economy, and more.

The Fed began aggressively raising rates in 2022 to combat inflation, going from a low of 0.25% to a high of 5.5% by July 2023. They've come down a bit since, now sitting at 4.5% since December of 2024.

A 25 basis point move would mean interest rates drop from 4.5% to 4.25%. The Fed typically lowers and raises rates in 25 bps increments, so any move greater than 25 bps would likely mean the cut would be 50 bps or more. They've made 50 bps or greater jumps several times in the last few years, including from 5.5% to 5% from August-September of 2024, and several more times on the way up in 2022.

Raising interest rates makes borrowing more expensive and slows down economic growth. Cutting rates encourages borrowing and investment on cheaper credit to stimulate economic growth. Experts fear that cutting rates now will result in increased inflation, but leaving rates the same or raising them could lead to wider-spread unemployment.