You’ve heard by now that the Big Ten’s TV deal spans seven years for at least $1 billion a year.

Wait a second.

How can that be? In this economy? With the state of the television industry in flux?

It is a remarkable number, even more stunning when you consider that neither Apple nor Amazon nor the incumbent ABC/Disney are involved in any capacity.

So how does this make sense?

For so long we were told that live sports were forever valuable because you couldn't skip commercials, one of two main revenue streams for the rights holders. Then came along a younger generation, who didn't feel the need to watch games, who were fine with highlights coming to their phone or watching snippets of GameCast.

That same generation also threatened the second revenue stream, cable subscriptions. They were the principal cord cutters.

And, all of a sudden, those who made programming for TV were left contemplating the future.

The obvious answer to the rights fee bump will be expansion. The addition of USC and UCLA in 2024 makes the Big Ten more valuable, as does the statement that they're not done.

But there are two other reasons.

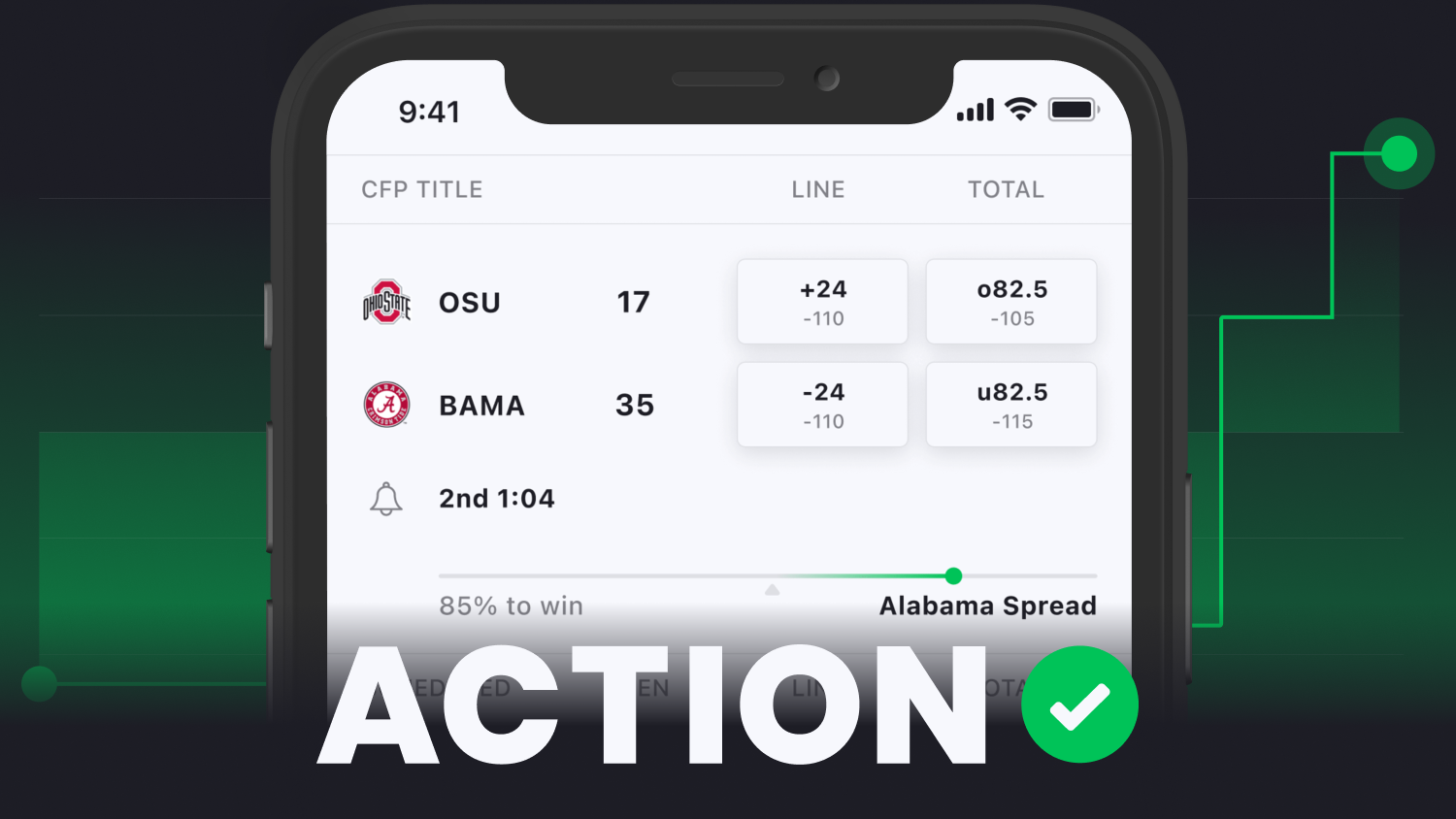

The primary one is gambling. The manifestation of gambling makes it impossible to avoid live, yes even for those who resisted it and even for the cord cutters. If you are gambling, you have to know what's happening in the moment, especially as live betting will only continue to grow.

It's with that in mind that the numbers start to make sense.

The second also involves roping that younger generation back in. Micro payments and live micro action is going to be a huge part of this deal. How do I know? Because it's the future.

You're going to be able to buy the last quarter for $2 or the last two minutes for 99 cents. It's been done by the NBA in recent years albeit quietly. And all that is going to add up really quickly. Trust me, everyone involved has done the math.