The 153rd Division-I college football season is almost here, and to get you ready for 15-hour Saturdays, Tuesday night MACtion, midnight Hawaii and five months of greatness, we've compiled 100 of the best betting notes from our analysts and experts.

Let's not waste any time and get to the list.

Let's Get Started…

1. Top Win Totals. Stuckey's eight best win total bets for the upcoming season.

Power 5 Win Totals: "Nebraska somehow went 0-8 in one-possession games in 2021, plus a ninth loss by nine points against Ohio State. Meanwhile, its three wins came by an average of just under 40 points. Remarkably, the Huskers finished 1-8 in the Big Ten with a net positive point differential."

Group 5 Win Totals: "This is by far the most talented team in the MAC (Toledo). That was also the case last season, but everything went against the Rockets, which makes them a very likely positive regression candidate in 2022."

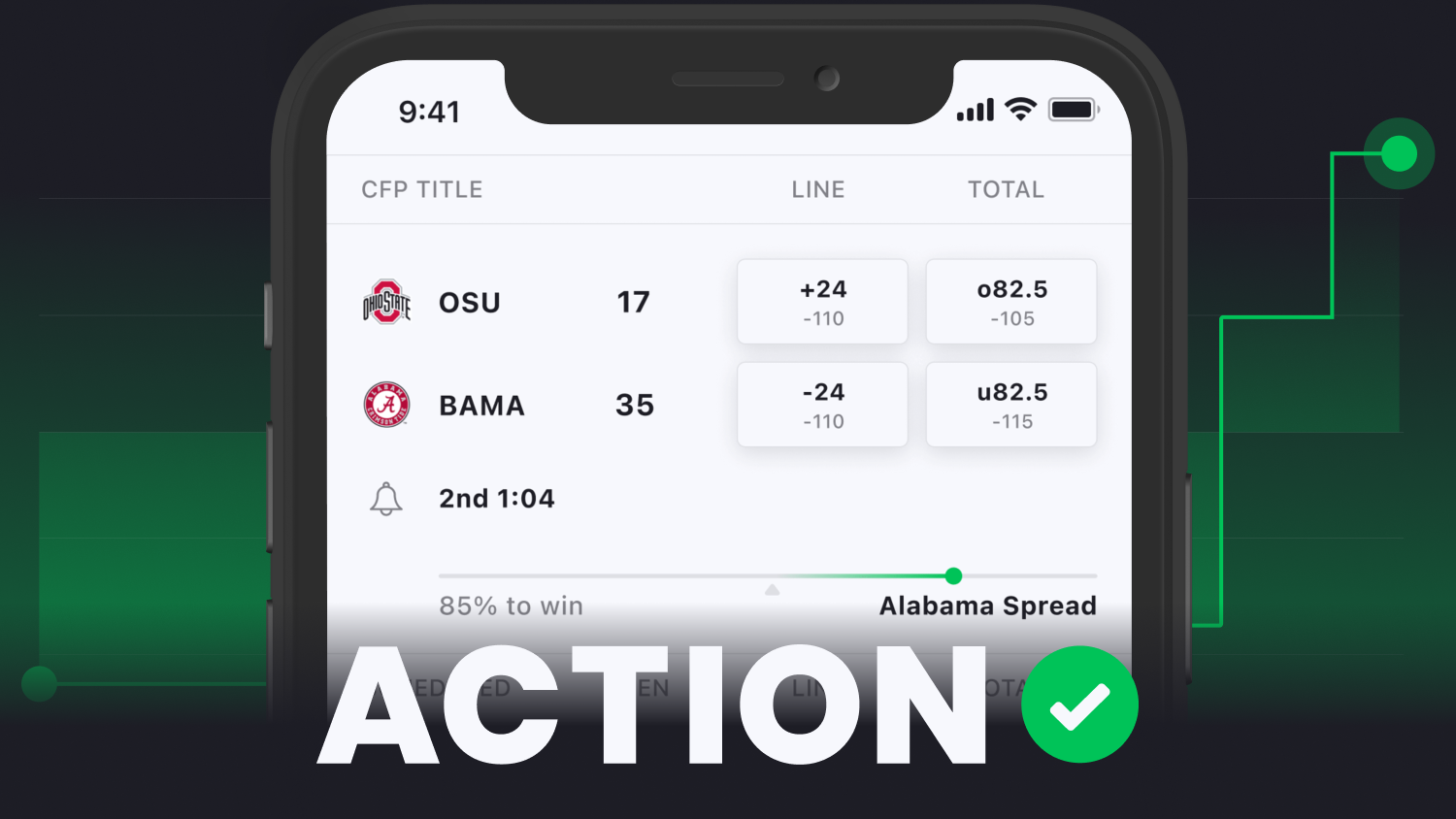

2. Chalk Title. Six of the last seven national champs were listed below +1000 entering the regular season. The lone exception? LSU in 2019, which won at 25-1.

3. Seeing The Future. Stuckey breaks down his seven favorite conference futures. "The Horns flopped in the second half of the season to finish with a stunningly disappointing 5-7 record, but they did go just 2-5 in one-score games. They were really just a few plays away from a nine- or 10-win season."

4. Tiger King. Looking for a longshot to win it all? Over the last 20 years, only three teams have won a national title with preseason odds of 40-1 or higher.

Longest Odds to win CFB National Title — Last 20 Years

- +5000: Auburn, 2010

- +4000: Ohio State, 2014

- +4000: LSU, 2003

5. McMurphy's Top 10. Our Brett McMurphy breaks down his AP preseason ballot, along with Action Network senior writer Collin Wilson’s power ratings.

"More disagreement between Collin and I regarding the teams I ranked between No. 11 and No. 20. Only three teams are in a similar range: Oklahoma (I ranked No. 13, Collin No. 20); Arkansas (I ranked No. 14, Collin No. 12) and Penn State (I ranked No. 16, Collin No. 19)."

6. Public Plague. Over the last two seasons, the betting public (51%+ of tickets) are 618-681-17 ATS (47.6%), with a return on investment of -8%. Since 2005, two of the three least profitable seasons for the public have come in the last two years.

Track the betting percentages on every single college football game all season for free on our Action Network public betting page.

7. The 655-1 Special. Mike Calabrese's five best picks to win a conference title this season. A five-team parlay between those picks? 655-1.

"Ryan Day is 23-1 in Big Ten play as the Buckeyes’ head coach, and now they have a chip on their shoulder after dropping two games last season and getting bullied by their arch-rival."

8. Cheat Sheet. To kick off our season-long college football coverage, Stuckey, Collin Wilson, Mike Calabrese, and Mike Ianniello from the Action Network Big Bets on Campus Podcast got in the lab and found their favorite win totals and futures bets across both the Power Five and Group of Five conferences.

9. The Over Problem. Last year in college football, the over went 355-416-9 (46%), losing a $100 bettor $9,128, a -11.7% return on investment — the worst season for the over in Bet Labs (since 2005).

In 2021, the average total points scored per game was 0.96 points below the listed over/under, the largest margin under the total since 2005.

The largest discrepancy last season came in August, September and October, where the over went 206-263-5 (43.9%), going under the total by 1.3 points per game. In November or later, the over went 149-153-4 (49.3%) last season.

Betting Trends

10. Downhill Chalk. Six teams are favored by 30 points or more in their season-opening games during Week 0 or Week 1.

During the last 5 years, teams favored by 30 points or more are just 35-49 (41.7%) ATS in their season openers, finishing below .500 ATS in all five years.

Between 2005 and 2016, teams favored by 30 points or more were 98-85-4 (53.6%) ATS in their openers — a sharp turn from their recent struggles.

11. Jet Lag. West Coast to the East Coast. Since 2005, teams that play in PST and play their next game on the road in EST are 40-56-3 ATS (41.7%), with a $100 bettor down $1,803. In September or earlier, those teams are 24-41-1 ATS (36.9%).

12. Here It Comes. Wait for the letdown. Over the last 15 years, unranked teams after beating a ranked team are 186-204-8 ATS (47.7%) in their next game. When those teams have 60%+ of betting tickets, they are 59-76-3 ATS (43.7%), losing a $100 bettor $2,013.

13. The party never stops. Over the last 15 years, unranked teams after beating a ranked team at home are 102-128-3 ATS (44.3%) in their next game, including 30-45-1 ATS (40%) when they play their next game also at home.

14. See over? Bet under. Over the last decade, when both teams are coming off 35-plus point performances in their previous game, the under is 472-399-12 (54.2%), with a $100 bettor up $4,425 (+5% ROI). Over the last five years, it spikes to 55.8% (+7.6% ROI).

15. Going Streaking. Entering the 2022 regular season, here are the longest active against-the-spread winning and losing streaks in college football.

Winning Streaks:

- 5: Central Michigan, Tulane & UAB

- 4: Vanderbilt

Losing Streaks:

- 7: Florida, Stanford & Temple

- 6: Colorado State & Duke

- 5: Florida Atlantic & FIU

- 4: Buffalo, Coastal Carolina, Indiana & New Mexico

16. The X-Factor. How does weather impact college football betting?

- In 90+ degree temperatures, the over is 120-92-1 (56.6%) since 2005. But in 2021, the over went 3-12.

- In freezing temperatures (32° or colder), the under is 50-21-2 (70.4%) when the wind speed is 10 MPH or higher (12-1-1 in last 14 plays since 2018).

- When the wind speed is listed at 20 MPH or higher, the under is 76-41-3 (65%) since 2005. When the Big Ten is the home stadium here, the under is 22-7-1 (75.9%) while going under by 5.8 points per game.

17. Bounceback Kings. Over the last 15 years, here are the three most profitable active head coaches against the first-half spread after a straight-up loss.

- Rick Stockstill: 48-30-2 ATS (61.5%), Middle Tenn, +$1,449

- Lane Kiffin: 25-10 ATS, FAU/TENN/MISS/USC, +$1,375

- Bret Bielema: 35-22 ATS, ARK/ILL/WISC, +$1,048

18. Comeback Kings. When trailing at the half, here are the most profitable coaches against the second-half spread over the last five seasons:

- Matt Campbell: 19-6-1 ATS, Iowa State, +$1,116

- Herm Edwards: 14-3 ATS, Arizona State, +$1,036

- Jeff Brohm: 16-7-1 ATS, Purdue, +$898

- Billy Napier: 12-3-1 ATS, UL Lafayette, +$840

- Tyson Helton: 13-4-1 ATS, Western Kentucky, +$774

Action Network Tools

19. Stay Sharp. If you want to make betting decisions for yourself, but don’t have the time to collect all the data, check out our College Football PRO Report. This analysis highlights five key bettings signals: big money, sharp action, expert projections, expert picks and historical betting systems.

20. Easy Picks. On this page, you'll see every game for each college football slate displayed, along with the number of picks from our Action experts for each market.

For example, you might see that eight of our Action experts are on the Penn State spread for a game, and from there you can dive into which experts are on that bet, see their betting records and more.

21. Track 'Em All. Georgia finally broke the 40-year curse and won the National Championship at the end of the 2021-22 college football season. Get National Championship odds here for the upcoming 2022-23 season and get ready to place your bets.

22. Who's In, Who's Out. It is always a good idea to review a team’s injury report before placing a wager on a game. Missing players can significantly impact a team’s ability to win games or cover a spread. Key injuries can also be a signal to bettors to wager against that particular team in a given day.

Be sure to keep a close eye on the Action Network’s NCAAF Injury Report with daily updates.

23. Volume Up. The podcast authority for college sports bettors everywhere, the Big Bets on Campus podcast is home to the Action Network's top-of-its-class college sports audio content.

Leading the way are veteran analysts and podcast teammates Stuckey and Collin Wilson, two of the most seasoned and successful college handicappers in the betting world today.

Heisman Trophy Breakdown

24. The Chosen One. The last time the preseason Heisman Trophy favorite won the award? 2014. Marcus Mariota won the award, opening at +425 odds for the Oregon Ducks.

25. Market Report. "However, it’s actually Stroud’s teammate, wide receiver Jaxon Smith-Njigba, who is the biggest liability at BetMGM. His odds have shifted from +5000 to +3000 to win the trophy. Smith-Njigba is getting 7.6% of the bets and 6.1% of the money."

26. Run Tide Run. The last time the preseason Heisman Trophy favorite wasn’t a QB? 2010. Mark Ingram was +400 after winning the Heisman in 2009. Cam Newton ended up winning the award in 2010, and he wasn't listed in the betting odds in the preseason, making him above 100-1 odds.

Service Academy Analysis

27. Anchor Down. Games featuring service academies — Army, Navy and Air Force — have gone 41-9-1 (82%) to the under since 2005, going under the total by 7.9 points per game. A $100 bettor would be up $2,959 betting Service Academy under's in that span.

The under has cashed in eight consecutive games, including going 22-2 (91.7%) since 2014.

28. Keep Dropping. When the over/under drops from the opening to closing lines in service academy games, the under is 29-4 (87.9%) since 2005, going under in 19 consecutive games.

29. They Cover, Too. Service academy teams have combined to go 134-107-6 ATS (55.6%) vs. non-service academy teams since 2014, going .500 against the spread or better in all eight seasons in that span.

Service academy teams are 21-9 ATS (70%) vs. non-service academy teams in bowl games since 2005, covering by 6.5 points per game.

Team and Conference Previews

SEC

30. Starting Strong. Over the last decade, SEC teams are 27-15 ATS (64.3%) vs. Power Five opponents in their season openers, including 21-9 ATS as a favorite.

Games in 2022: Florida vs. Utah, Georgia vs. Oregon and LSU vs. Florida State.

Alabama Crimson Tide

31. Low Tide. Alabama is currently listed at +190 to win the National Championship. The 2022 Tide would be the 12th team in the last 20 years to enter the regular season with title odds below 3-1.

- 10+ Wins: 11 of 11

- Made Nat’l Title: 4 of 11

- Won Nat’l Title: 1 of 11 (2017 ALA)

- Undefeated: 0 of 11

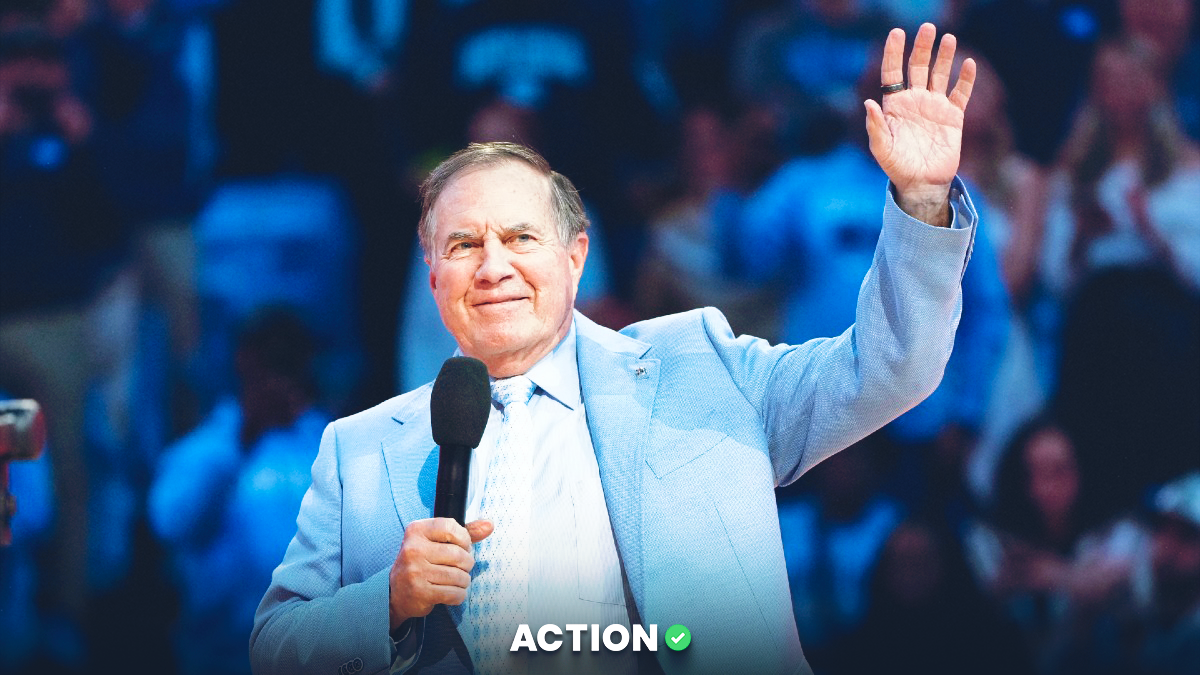

32. 'Bama First. Alabama’s win total is listed at 11.5 for 2022. The Tide went under their win total in 2020 and 2021, the first time ‘Bama went under in consecutive years under Nick Saban.

33. Half Man. Saban is 115-82-5 (58.4%) against the first-half spread, profiting a $100 bettor $2,292. Since arriving at Alabama in 2007, Saban is the third-most profitable first-half coach ATS.

- In October or earlier, Saban is 71-41-3 1H ATS (63.4%), including 21-8 1H ATS in the last four seasons.

- Over the last four seasons, Alabama is 36-18 1H ATS (66.7%), making Saban (+$1,408) the most profitable in that span.

34. Hot Opener. In the first game of the season, Saban is 14-0 SU and 12-2 ATS at Alabama, covering by 8.1 points per game. Saban is the most profitable coach in the opener in Bet Labs (since 2005).

As a 30-point favorite or higher, Alabama is 3-0 SU/ATS in its opener under Saban, winning by a combined score of 138-13 and covering the spread by a tight 4.2 points per game.

Georgia Bulldogs

35. Strong Start. The reigning national champs are 21-1 SU and 16-6 ATS in their first game of the following season since 2000. The only loss came at the hands of LSU in 2020.

36. Top Dawg. Since Kirby Smart was hired by Georgia in 2016, the Bulldogs are 47-34 ATS, profiting a $100 bettor $967. That makes Georgia the most profitable team ATS in the SEC.

37. Away From Athens. Under Smart, Georgia is 32-14 ATS (69.6%) away from Athens, profiting a $100 bettor $1,592.

Most Profitable Coaches Away/Neutral ATS – Last Decade

- Philip Montgomery, Tulsa: 32-13 ATS (71.1%), +$1,751

- Kirby Smart, Georgia: 32-14 ATS (69.6%), +$1,592

- Dabo Swinney, Clemson: 43-27 ATS (61.4%), +$1,383

Mississippi State Bulldogs

38. Tenured Man. Historically, coach Mike Leach has fared very well with third-year starting quarterbacks, having won at least nine games in each of the three prior instances.

39. Anti-Stark. In the Bet Labs database, dating back to 2005, Mississippi State's least profitable opponent against the spread? Alabama.

Vanderbilt Commodores

40. When Will It End? Entering the 2022 regular season, Vanderbilt has lost 21 consecutive SEC games straight up (it's 10-11 ATS in that span).

Vandy's last win vs. an SEC opponent? In 2019 at home as a 21-point underdog vs. Missouri and quarterback Kelly Bryant. The Commodores' last win vs. an original SEC member? November 24, 2018, as a 3.5-point favorite against Tennessee.

41. Chasing History. No team has lost more than 21 consecutive conference games straight up since Kansas in 2013, which lost 27 consecutive between 2010 and 2013 in the Big 12.

Based on Vanderbilt's eight-game 2022 SEC schedule, if the Commodores went winless, they would match Baylor's streak of 29 games between 1998-2001 (sixth-most all-time).

Arkansas Razorbacks

42. Money Start. Arkansas is 15-7 ATS under Sam Pittman (+$701), the most profitable coach in the SEC over the last two seasons.

43. Undefeated. Pittman is 5-0 against the spread in September or earlier in his coaching career. Since 2005, no coach has had more wins without a loss ATS in September or earlier than Pittman.

Tennessee Volunteers

44. Typical Tennessee. The least profitable teams against the spread in the SEC over the last five years? The Tennessee Volunteers at 22-36-1 ATS (37.9%), losing a $100 bettor $1,566 in that span.

45. No back-to-back. Over the last five seasons, two Power Five teams have struggled the most when it comes to covering the spread after a win, with USC (10-22-1 ATS | 31.3%) and Tennessee (8-18 ATS | 30.8%) being those programs.

Florida Gators

46. Gator Bait. Both Florida (+2.5 vs. Utah) and Florida State (+3.5 vs. LSU) are listed as underdogs in their openers this season. This will be just the second time since 1980 that both teams will be underdogs in their openers (2017; FSU +7 lost vs. ALA, UF +4 lost vs. MICH).

47. Florida, Man. Entering the 2022 regular season, Florida has lost seven consecutive games against the spread. That is tied with Stanford and Temple for the longest ATS losing streaks entering the year.

48. Billy Boy. Florida hired new head coach Billy Napier entering this upcoming season. Napier will look to break the Gators' ATS streak. Since Urban Meyer left in 2010, the three head coaches to take over the Gators have each produced a negative ROI against the spread.

Auburn Tigers

49. Don't Give Up. Auburn coach Bryan Harsin was with Arkansas State back in 2013, coached Boise State from 2014 to 2020 and is now with the Tigers for his second season.

One thing we've learned about Harsin: if he has a lead, don't give up.

Harsin's teams are 22-41-1 (34.9%) against the second-half spread when his team ends the first half with a lead. That makes him the least profitable coach against the second-half spread since 2013, losing a $100 bettor $2,080 (a -32.5% ROI).

50. Sign of the Times. Auburn is listed at 150-1 to win the SEC entering this season, its longest odds to win the conference since 2000.

Only one other time has Auburn been listed at 100-1 or longer to win the conference in that span. That was in 2013, when it was 100-1 to win the SEC, won the conference and went to the BCS Championship Game behind Nick Marshall and Tre Mason.

Kentucky Wildcats

51. Cardiac Cats. Kentucky is currently listed at 50-1 to win the SEC, the Wildcats' lowest odds to win the crown since also being listed at 50-1 back in 2010 (Kentucky ended up winning six games in Joker Phillips' first season).

Kentucky is one of four SEC teams to never have even participated in the SEC Championship Game in its history since 1992 (Ole Miss, Texas A&M, Vanderbilt).

52. Follow The Lead. Under Mark Stoops, Kentucky tends to continue the streak after a win or loss more than not.

After a straight-up win at Kentucky under Stoops, the Wildcats are 32-21-1 ATS (60.4%), covering the spread by 4.2 points per game (+16.6% ROI).

After a loss in their previous game, the Wildcats are just 18-29-1 ATS (38.3%), failing to cover the spread by 2.2 points per game (-25.2% ROI).

Big Ten

Michigan Wolverines

53. The Best of Jim. Bettors know Michigan has been good for two things since coach Jim Harbaugh took over in 2015 after his time at Stanford: covering the first half and the over.

- First Half: Harbaugh in his college coaching career is 81-51-3 (61.4%) against the first-half spread, profiting a $100 bettor $2,351 (+17.4% ROI). Since taking over at Stanford in 2007, Harbaugh is the most profitable coach against the first-half spread in the country.

- Overs: The over is 78-55-1 (58.6%) in Harbaugh-coached games, the most profitable coach to the over in our Bet Labs database (which goes back to 2005). At Michigan alone, the over is 51-33-1 (60.7%) with Harbaugh at the helm, including 39-21 (65%) vs. Big Ten opponents.

54. It's Been A While. No Michigan quarterback has won at Ohio State since Drew Henson in 2000. The Wolverines can break the streak this season.

Michigan QB to win in Ohio State since 1990

- 2000: Drew Henson

- 1996: Scott Dreisbach/Brian Griese

- 1990: Elvis Grbac

Ohio State Buckeyes

55. Hello Irish. Ohio State faces Notre Dame in its opener on September 3. The Buckeyes are 4-0 straight up and against the spread vs. Notre Dame over the last 50 years.

56. Early Buck. Under Ryan Day, Ohio State is 13-4-1 ATS (76.5%) in October or earlier, covering the spread by 11.4 points per game. Since 2019, only one coach in the country is better ATS than Day — Mike Gundy at 15-5 ATS in October or earlier.

Nebraska Cornhuskers

57. Tough Start. Nebraska has lost five consecutive openers against the spread since 2017 by 11.6 points per game. The Cornhuskers are one of four teams who are 0-5 ATS in that span (Akron, Nebraska, New Mexico, Oregon State).

58. Not The Same. Scott Frost is 18-22-2 ATS since joining Nebraska, which is not exactly the same results for bettors that he had at UCF.

Scott Frost ATS by school

- UCF: 16-9-1 ATS (64%), +5.9 PPG, +$592

- Nebraska: 18-22-2 ATS (45%), -1.71 PPG, -$489

59. Avoid The Chalk. As a favorite at Nebraska, Frost is 7-14 ATS (33.3%). Since being hired in 2018, a $100 bettor would be down $746 (ranked 197 of 200 head coaches).

60. One and Done. From Stuckey's Power 5 Win Totals: "Nebraska somehow went 0-8 in one-possession games in 2021, plus a ninth loss by nine points against Ohio State. Meanwhile, its three wins came by an average of just under 40 points. Remarkably, the Huskers finished 1-8 in the Big Ten with a net positive point differential."

Minnesota Golden Gophers

61. Full Fleck. Over the last three seasons, the Gophers are 9-0 SU and 7-1-1 ATS with over a full week to prepare (eight or more days; covering the spread by 8.1 PPG). When they are listed as underdog in this spot, the Gophers are 5-0 SU/ATS.

62. Cover Gophers. In the last decade, Minnesota is 67-50-6 ATS (57.3%), profiting a $100 bettor $1,306, the fifth-most profitable team ATS in the country (5 of 252) and the best in the Big Ten.

Northwestern Wildcats

63. Avoiding The Kliff. Since joining Northwestern in 2006, Pat Fitzgerald has been a good bet late in the season vs. early on.

Pat Fitzgerald as Northwestern Head Coach

- Aug-Oct: 52-65-2 ATS (44.4%), -$1,650, -13.9% ROI

- Nov-Jan: 44-29-2 ATS (60.3%), +$1,282, +17.1% ROI

64. Off To Ireland. Northwestern and Nebraska open the season at Aviva Stadium in Dublin, Ireland. Over the last five years, the under is 36-21-1 (63.2%) in neutral site games, going under the total by 3.8 points per game.

Big 12

65. Keep It Going. New Big 12 slogan: "Looking for an early season wager? Bet the Big 12 while we are still here!" All other Power Five conferences have struggled against the spread early in the year.

The Big 12 … not so much.

Most Profitable Power 5 Conference ATS — Sept. or earlier last decade

- Big 12: 200-172-7, +$1,500

- ACC: 277-276-19, -$1,568

- Big Ten: 237-275-11, -$1,632

- SEC: 285-294-9, -$2,666

- Pac-12: 237-258-6, -$3,568

Oklahoma Sooners

66. From Way Downtown. Oklahoma is currently listed at +3500 to win the national title, their longest odds entering a regular season over the last 20 years.

67. Low Expectations. Oklahoma’s win total is listed at nine this season, the Sooners' lowest win total since being listed at 8.5 in 2015.

The Sooners have gone under their win total in consecutive years (2020-21) for the first time since going under in three straight years between 2009-11.

Texas Longhorns

68. The Long Run. People continue to ask what is the sign of “Texas being back?” Maybe it’s the Longhorns' win total.

Since 2010, Texas has gone under its preseason win total in 11 of its last 12 seasons, going over only in 2018 by 0.5 wins.

69. Home, Sweet, Home. In Steve Sarkisian's coaching career, he is 32-19 (62.7%) against the spread at home. Each of the four teams he's coached in college — Washington, USC, Texas, Alabama — were all above .500 against the spread at home.

Oklahoma State Cowboys

70. Early Riser. Similar to Oklahoma State's conference itself, the Cowboys have excelled against the spread earlier in the season (vs. late) under coach Mike Gundy. Over the last three seasons in October or earlier, Oklahoma State is 15-5 ATS.

Gundy ATS at Oklahoma State

- Aug-Oct: 79-47 ATS (62.7%), +$2,792, +22.2% ROI

- Nov-Dec: 34-37 ATS (47.9%), -$513, -7.2% ROI

71. Boomer Sooner. Overall in the Bet Labs database, Gundy is the most profitable coach against the spread since 2005, going 124-89 ATS (58.2%), profiting a $100 bettor $2,823. But against the Cowboys' rival Oklahoma, that's a different story.

Gundy ATS at Oklahoma State

- Versus Oklahoma: 4-13 ATS

- Versus Other Teams: 120-76 ATS

72. Road Cowboys. Over the last three seasons, Oklahoma State is 22nd in the country in total points and 21st in total points on the road.

So, it may surprise you to see that the under is 14-5 (73.7%) in that span when Oklahoma State plays on the road, going under the total by 4.2 points per game. Gundy is the third-most profitable coach on the road to the under in that span.

TCU Horned Frogs

73. Moving On. After 21 seasons with Gary Patterson, TCU has found its new coach in Sonny Dykes. Dykes first got his debut in 2010 with Louisiana Tech and then moved to Cal before stopping at SMU.

In Dykes’ coaching career, his teams have leaned toward the over, especially in the second half.

Dykes’ teams are 78-48-1 (61.9%) to the over in the second half, profiting a $100 bettor $2,278, most of any coach in CFB since 2005. This includes a mark of 40-15-2 (72.7%) since 2016 and going over in SMU’s last six games last season.

Iowa State Cyclones

74. Different Times. Matt Campbell arrived in Ames in 2016 with Iowa State seeing an eight-win season just once (!) since 1979 (back in 2000).

With lower expectations, Campbell and Iowa State went 11-4 ATS in 2016 and 2017 as underdogs, helping its 18-7 ATS overall record. Since then, it hasn't been as pretty.

Campbell ATS at Iowa State

- 2018-21: 23-26-1 ATS (-$453)

- 2016-17: 18-7 ATS (+$992)

Kansas State Wildcats

75. Top Cat. Since hiring Chris Klieman in 2019, Kansas State is 22-12-1 ATS, making a $100 bettor $837 and covering by 4.3 points per game. In that span, the Wildcats are the fourth-most profitable team in college football (out of 223 teams).

Most Profitable CFB Team ATS since 2019

- Oklahoma State: 25-12 ATS (+$1,118)

- Kentucky: 22-12-2 ATS (+$847)

- Notre Dame: 24-14 ATS (+$842)

- Kansas State: 22-12-1 ATS (+$837)

Pac-12

USC Trojans

76. Falling Short. Since Pete Carroll moved from USC to the Seahawks in 2010, the Trojans have gone under their preseason win total in eight of the last 11 seasons.

In that span, they’ve had a win total of 9.5 or more four times, and they’ve gone under all four times.

77. Conference Catastrophe. Entering the 2022 season, USC has lost five consecutive games against the spread vs. the Pac-12, the Trojans' longest such streak since 2009 (also five consecutive ATS losses).

Oregon Ducks

78. Duck to Dog. Oregon is listed as a 17.5-point underdog in its opener vs. Georgia. The Ducks haven’t been listed as a bigger underdog since facing Matt Leinart, Reggie Bush and USC back in 2005 (+19.5; lost 45-13).

Oregon biggest underdog since 2005

- +19.5: 2005 vs. USC (L, 45-13)

- +17.5: 2022 vs. Georgia

- +17.5: 2017 at Washington (L, 38-3)

- +17: 2016 at USC (L, 45-20)

- +16.5: 2008 at USC (L, 44-10)

79. Ducks over Huskies. Dating back to 2004, Oregon is 14-2-1 (87.5%) against the spread vs. Washington, the Ducks' most profitable opponent ATS in that span.

Utah Utes

80. Mr. Consistency. Utah has finished above .500 ATS in six consecutive years (2016-21). In that span, Utah is the fifth-most profitable team ATS in the country (fifth of 245 teams).

81. Leader of the Pac. Since leaving for the Mountain West for the Pac-12 in 2011, Utah is 75-59-1 ATS (56%), profiting a $100 bettor $1,113, the most of any team in the conference.

ACC

82. Comeback Campaign? For the first time since the birth of the College Football Playoff, the ACC had no representative in the national semifinals last season.

Currently at DraftKings, only two ACC teams are listed in the "make playoff" market: Clemson at +145 and Miami at +1200.

Clemson Tigers

83. Falling Off? Clemson has gone under its win total in back-to-back seasons (2020-21). Between 2011 and 2019 — a total of nine seasons — the Tigers went over their win total all nine times.

84. Bettor's Feeling it. Clemson finished under .500 ATS in consecutive seasons (2020-21) for the first time under Dabo Swinney (2008-22).

85. Ride The Tigers. When Clemson rolls, don’t get off the train. No head coach is better at covering after a straight-up and against-the-spread win than Swinney.

Clemson is 53-34 ATS (60.9%) in that spot, covering by 3.9 points per game. When the game comes away from home — either neutral or as a visitor — Clemson is 33-12 ATS (73.3%).

Miami Hurricanes

86. Forget The Past. After five years at Oregon, Mario Cristobal is beginning his first season at Miami.

One area of struggle the Hurricanes hope Cristobal has left in Eugene is his record as a favorite.

In his coaching career, Cristobal is 15-25 ATS (37.5%) as a favorite of a TD or more, including finishing .500 or worse ATS in all 11 years of his college coaching career.

Florida State Seminoles

87. Turn It Around. Over the last five seasons, Florida State is 21-34-3 ATS (38.2%), the least profitable team ATS in the ACC among 14 teams.

88. Bowl Drought. Florida State hasn't won a bowl game since beating Southern Mississippi in the Independence Bowl back in December of 2017. The four-year drought without a bowl win is the longest for the Seminoles since 1978-81 under Bobby Bowden.

Duke Blue Devils

89. ACC Issues. Over the last two seasons, Duke is 3-14 ATS in ACC play (-$1,117 on $100 bets). It is the least profitable team in conference play in all of college football.

90. Feeling Blue. Duke enters the regular season on a six-game against-the-spread losing streak, which is tied for the second-longest losing streak in the country.

Longest ATS Losing Streaks — Entering 2022 CFB Regular Season

- 7: Florida, Stanford & Temple

- 6: Colorado State & Duke

Mountain West

Fresno State Bulldogs

91. Bulldogs Lead The Way. Our best win total bets for the conference. "My numbers have the Bulldogs as double-digit favorites in eight of their games this season. An undefeated regular season isn’t out of question with an upset over USC."

Colorado State Rams

92. Hot Jay. With Nevada for five seasons, head coach Jay Norvell, who is now with Colorado State, is 5-0 against the spread in his team's opening game of the season.

Hawaii Rainbow Warriors

93. Back Home. Last year, Hawaii finished 3-1-1 ATS at home, its first year above .500 at home ATS since going 7-0 ATS in 2010-11 with Bryant Moniz.

94. Staying Home. In 2021, Hawaii didn’t play back-to-back home games for the first time in over 15 years.

That was probably for good reason. Since 2005, the Rainbow Warriors are 10-23 ATS (30.3%) when playing on a homestand (second game or later of homestand/at home), losing a $100 bettor $1,387 — the second-least profitable school in the FBS over that span, ahead of just Purdue (-$1,550).

95. Hello Hawaii. Vanderbilt opens the season on the road in Hawaii. Since 2005, teams playing their first game of the year on the road against Hawaii are 4-5 SU and 1-7-1 ATS.

Sun Belt

96. App State or Nothing? Our favorite win total bets for the Sun Belt conference.

"Coastal Carolina, Appalachian State and Louisiana have dominated the competition, boasting a combined 64-12 record since 2020. The rest of the conference has won just 37% of its 152 games in that span."

FBS Independents

Notre Dame Fighting Irish

97. Buckeyes Early. With a victory over Ohio State, it would be Notre Dame’s biggest upset since taking down No. 11 UCLA as a 21-point underdog back in 2007.

98. Big Number. Notre Dame is listed as a 16-point underdog in its season opener against Ohio State — the biggest underdog in an opener for the Irish in the last 50 years.

Biggest Notre Dame Underdog in Opener — Last 50 Years

- +16: 2022 at Ohio State

- +13.5: 2001 at Nebraska (L, 27-10)

- +6.5: 1986 vs. Michigan (L, 24-23)

- +6: 1998 vs. Michigan (W, 36-20)

- +6: 1979 at Michigan (W, 12-10)

- +3.5: 1987 at Michigan (W, 26-7)

UConn Huskies

99. Lost Dog. Connecticut hasn’t finished a season above .500 against the spread since going 8-5 ATS in 2010, a streak of 10 seasons where it is 39-77-3 ATS (33.6%). That makes the Huskies the least profitable team ATS in college football (252 teams; losing a $100 bettor $4,014).

UMass Minutemen

100. Uphill Climb. UMass is 9-19 ATS (32.1%) over the last three seasons. The Minutemen are ranked 215th of 223 total teams in that span. The biggest advantage to betting against UMass has been in the first half.

Massachusetts is 7-21 (25%) against the first-half spread over the last three seasons, failing to cover the spread by six points per game in the first half. UMass has covered one of its last 10 first halves entering the 2022 season.